Predictably Misbehaving

Lecture 3: Libertarian Paternalism

Joshua Foster at UW-Oshkosh

Public Policy

The implementation of governmental instruments to solve societal problems.

Libertarian Paternalism

A process in which a Choice Architect designs an economic environment with the explicit intent of helping individuals making suboptimal decisions (as judged by themselves), while not significantly harming individuals whose behavior is already optimal (as judged by themselves).

The Libertarian Paternalism policy designation is traditionally reserved to situations in which a Choice Architect is inevitable.

- Libertarian Paternalism is an "ideal" that cannot be applied to all situations.

The Philosophy of Libertarian Paternalism:

- Respecting individual liberties while considering necessary environment designs.

- Sometimes it is impossible to avoid imposing some "policy".

- So make a policy that incentivizes better decisions (without restricting freedom).

Example: food choice.

The policy should be flexible.

- Allows for the Choice Architect to be wrong.

Dick Thaler, on Nudges

A Smoking Policy

A large tax on smoking is not libertarian paternalistic.

- If we're wrong about people's behavior and preferences, it perpetually hurts smokers without the intended benefit.

An alternative is a one-time licensing fee.

- Choose to become "licensed to smoke" at a price $L$.

- Assume there is no resale nor any black market.

Set $L$ such that it motivates some to stop smoking.

Nudges by Default

A Bad Nudge

A Good Nudge

A Bad Nudge

A Good Nudge

Applications of Nudges

How Much to Save?

It's not clear how much people should be saving for retirement. However...

- 68% of people say their saving rate is too low.

- 1% say their saving rate is too high.

How can we encourage people to save more?

Defaults as one approach to saving.

- Assumption 1: people are most impatient in the present.

- Therefore, they are under-saving.

- Assumption 2: people are loss-averse.

- Therefore, they prefer savings to come from sources outside of their reference income.

Default: save out of future raises, then people will be more likely to actually do it.

A Brilliant Example of Libertarian Paternalism

Benartzi and Thaler (2004) in J. of Pol. Economy

- Can libertarian paternalism increase savings?

- The authors worked with a company seeking to increase their employees' savings rates.

How this (and most) companies work:

- The company hired a financial advisor.

- Recommended a specific savings rate.

- Some of them agreed, some did not.

- The authors worked with those who did not.

What did the authros do with these under-savers?

- Created the Save More Tomorrow (SMarT) Plan

"Would you like to increase your savings with your next raise?"

- If no, then nothing happened.

- If yes, then their savings rate increased.

- The amount was less than their raise.

- Continued at each raise, up to a preset maximum.

- They could easily opt out of the plan at any time.

Results: by the third raise, SMarT participants were saving...

- More than those working with the financial advisor.

- About twice as much as those with no plan.

Saving for Retirement

The government makes savings decisions for you.

- Social security collects taxes and returns it later on.

- However, this system is strained.

- When created, length of retirement was about 5 years on average.

- Now, length of retirement is about 18 years.

Today, many must save in tax favored retirement accounts.

This means people must try to calculate:

- Their lifetime earnings.

- Their optimal retirement age.

- What standard of living they want.

- How much to pay themselves each year.

People don't do this very often...and honestly, most economists don't do this.

Why did SMarT Work?

Because it accounts for many behavioral principles.

- It places the increase in savings in the future.

- Sidesteps people's short-run impatience.

- It doesn't require a decrease in consumption.

- In fact, can still gain in pay raises.

- It creates an immediate cost of switching.

- Which makes it more likely they'll stick to it.

Milton Friedman

On Regulation

"There is no place for government to prohibit consumers from buying products the effect of which will be to harm themselves."

- Milton Freidman

Organ Donations

Since 1988:

- 360,000 organs have been transplanted.

- 80% are from deceased donors.

As of 2006:

- 90,000 Americans are on a waiting list.

- 60% will die waiting.

- The list grows at 12% per year.

How can we help?

Explicit vs. Presumed Consent

In many places people must state their willingness to be a donor.

In a study of Iowa:

- 97% of respondents personally stated they'd like to be donors.

- Of those, 43% had signed their organ donor card.

So instead let's assume people are consenting donors.

- Must state their preference to not participate.

Johnson and Goldstein (2003) used online surveys to ask people's willingness to be donors with different defaults.

- No default (must choose): 79%

- Explicit consent default: 42%

- Presumed consent default: 82%

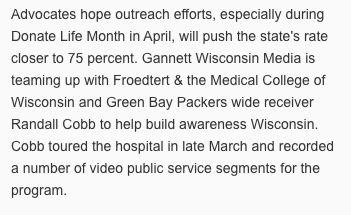

Organ Donations in Europe

Organ Donations in Wisconsin