Behavioural

Economics

Session 3

Joshua

Foster

Agenda

- Case: Nestle's Maggi Pricing and Repositioning a Recalled Product.

"Pain, I have already had occasion to observe, is, in almost all cases, a more pungent sensation than the opposite and correspondent pleasure." - Adam Smith, Theory of Moral Sentiments (1759)

What is the Nestle Maggi crisis at hand?

How does Maggi create value for its customers?

How were these sources of value challenged by the crisis?

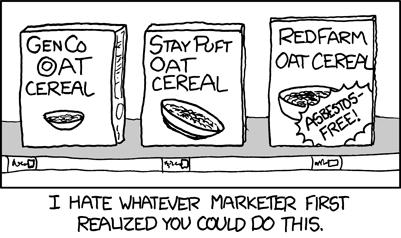

In a nutshell, Maggi's problem (XKCD comic).

From Session 1: what are the two most important components of an economic experiment?

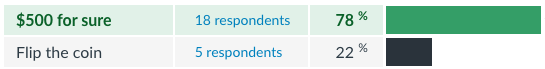

Survey questions.

| "Would you choose to gain 500 dollars with a 100% chance or gain 1000 dollars with a 50% chance?" | "Would you choose to lose 500 dollars with 100% chance or lose 1000 dollars with a 50% chance?" |

(Risk-averse behavior) |  (Risk-loving behavior) |

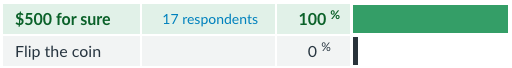

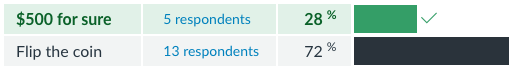

Survey questions.

| "Would you choose to gain 500 dollars with a 100% chance or gain 1000 dollars with a 50% chance?" | "Would you choose to lose 500 dollars with 100% chance or lose 1000 dollars with a 50% chance?" |

(Risk-averse behavior) |  (Risk-loving behavior) |

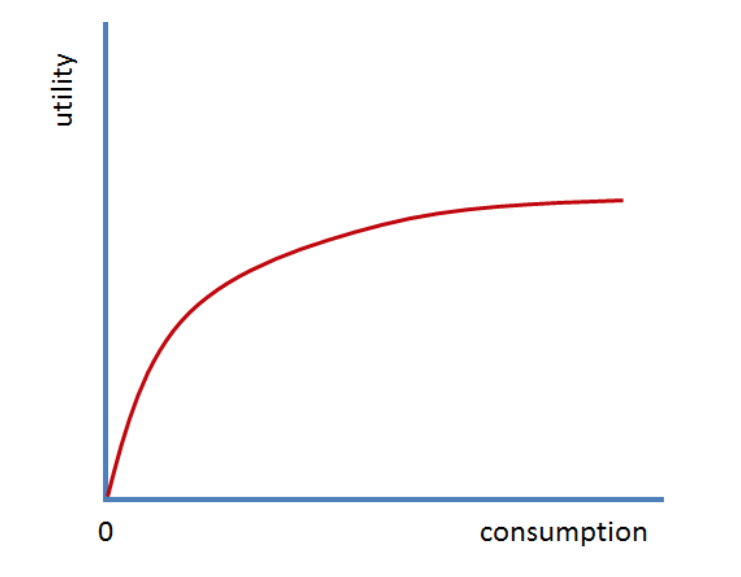

Evaluating value over gains.

Evaluating value over losses.

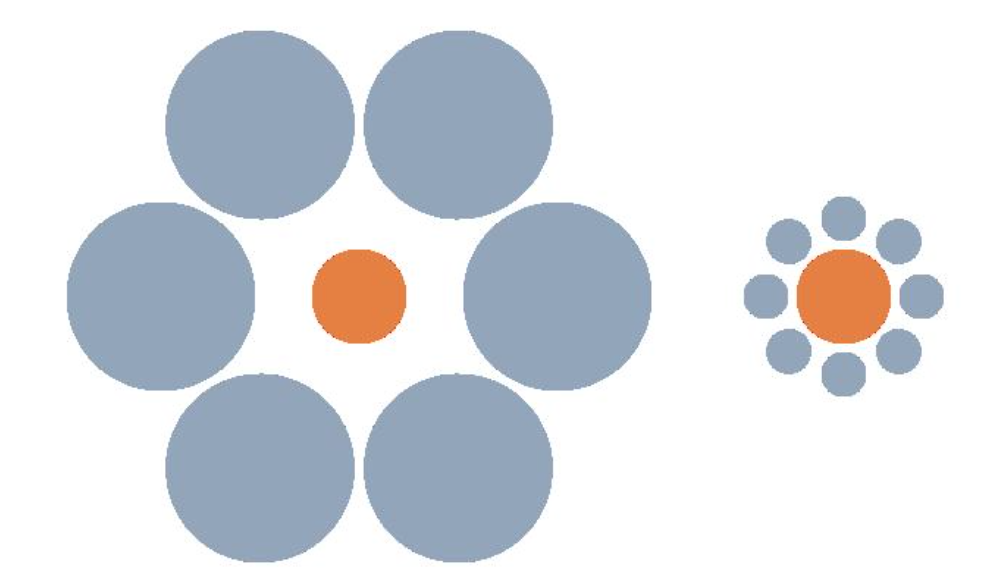

The Size-Contrast Illusion.

The Ponzo Illusion.

Our brains make relative comparisons, not absolute.

- Brightness, loudness, temperature...all relative.

- So are many of our experiences.

We find comparative judgments much easier to make.

- It's easy to tell which of two buckets of water is warmer.

- It's hard to tell their absolute temperature.

Today's Major Takeaway

Evaluations of economic outcomes are heavily influenced by comparisons.

If absolute consumption is what made people happy...

- We should be happier than people 100 years ago.

- (e.g. electricity, indoor plumbing, entertainment)

Traditional utility.

|

Traditional utility depends on absolute valuation.

|

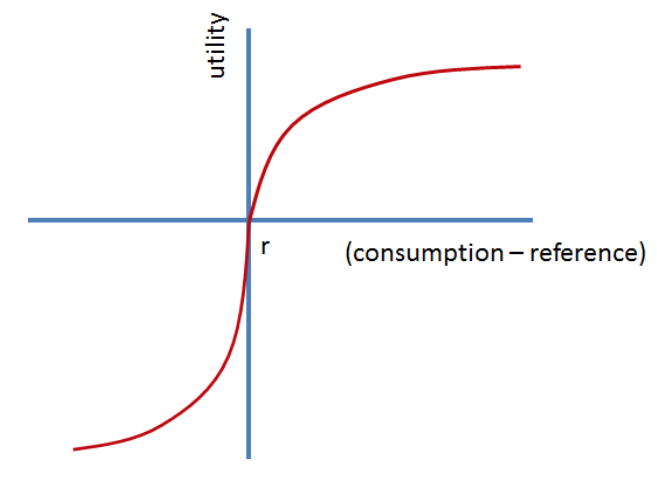

Reference-dependent utility (Prospect Theory).

|

Reference-dependent (RD) utility depends on relative valuation.

|

Loss Aversion.

For the consumption of something particular, people dislike losses relative to their reference point more than they like same-sized gains.

The inclusion of loss aversion is one of the most important properties of reference-dependent utility.

Evidence of Loss Aversion.

Back to Maggi: strategies that utilize Prospect Theory.

How will these strategies use Prospect Theory?

What challenges will Nestle face in implementing these changes?

How will B2B and B2C customers respond differently to these strategies (if at all)?

Determining the optimal strategy is part art, part science.

- How is the customer framing the product?

- What is setting their reference point?

- What outcomes will induce a loss sensation?