Behavioural

Economics

Session 8

Joshua

Foster

Agenda

- MobLab: In-class Simulation.

- Case: WSB and the Impact of Social Dynamics on Economic Biases.

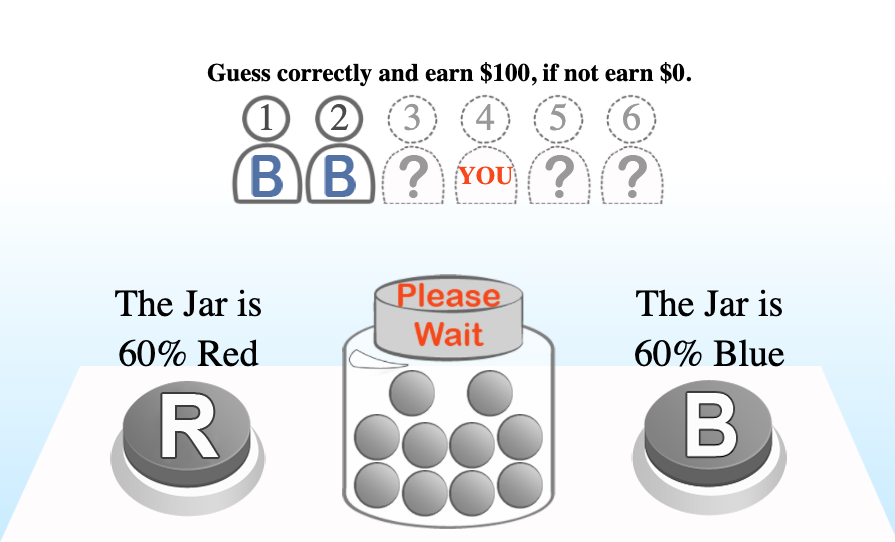

Simulation instructions.

- The situation: there is a jar that contains only blue and red balls (you can't see them).

- What you do: you must determine whether the jar has a majority (60%) of blue balls or red balls.

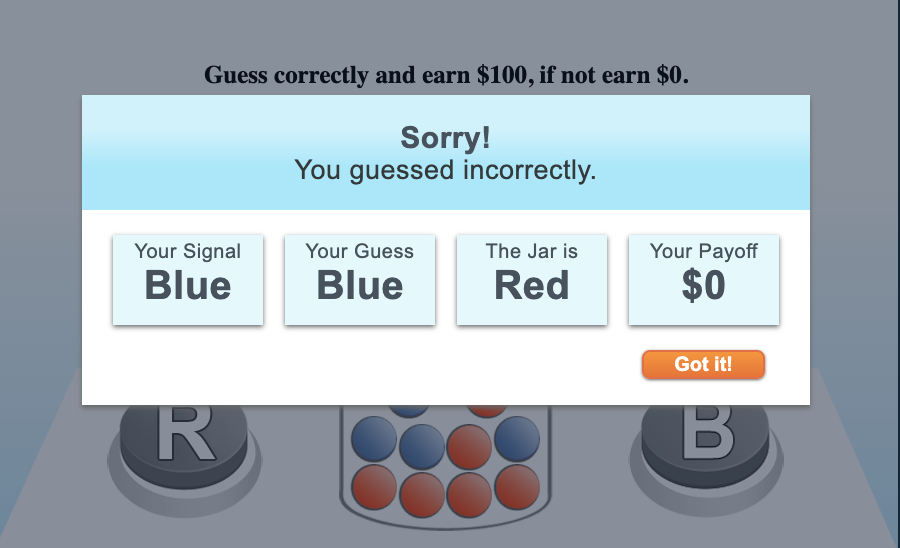

- If you guess correctly, you get 100 bragging right points, otherwise you get nothing.

Simulation instructions.

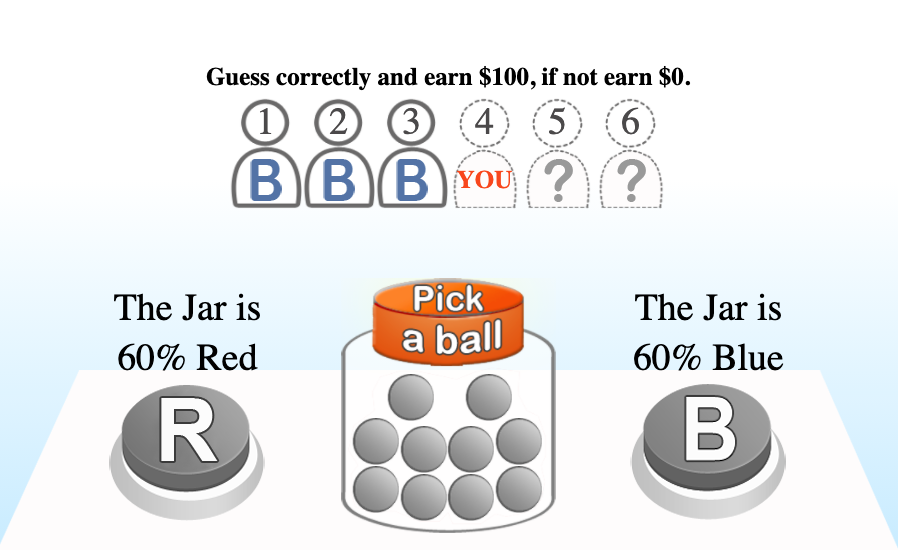

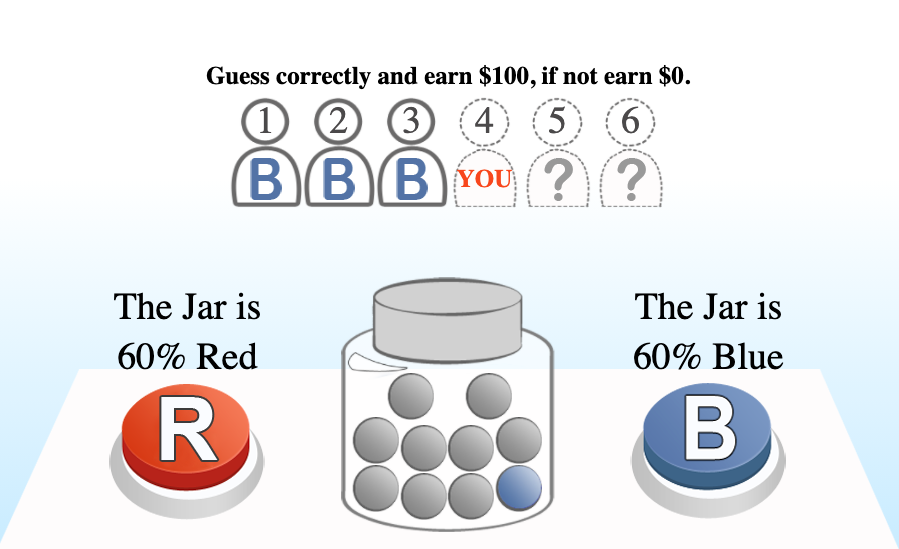

- How it works: each member of a group (6 members total) will take turns privately drawing a ball from the jar, observe whether their draw is blue or red, and then put it back. Then, they make their guess for what the majority color is and share this guess with the rest of the group.

- Once everyone in the group has drawn a ball and revealed their guess, the group will learn the true majority color.

To summarize:

- You'll be randomly placed into groups of six.

- Members of your group will take turns privately drawing a ball from the jar with replacement.

- Each member will signal to the others what color they think the majority color is.

- The true majority color is revealed once all guesses are made.

- Fake internet points ensue to correct guessers.

- Rinse and repeat a few times.

Questions?

What happened in the simulation?

What specifically made this task difficult?

Survey Item

Suppose 1 out of 100 people have COVID. Additionally, suppose we have a test for COVID that is 99% accurate. Specifically, this means that if a person has COVID, the test returns a positive result with 99% probability, and if a person does not have COVID, it returns a negative result with 99% probability.

If a person’s COVID test comes back positive, what is the probability that they have COVID?

Using Bayes’ Theorem:

\( P(\text{COVID} \mid +) = \dfrac{P(+ \mid \text{COVID}) \, P(\text{COVID})}{P(+)} \)

\( P(+)= P(+ \mid \text{COVID})P(\text{COVID}) + P(+ \mid \text{No COVID})P(\text{No COVID}) \)

\( P(+)= (0.99)(0.01) + (0.01)(0.99) = 0.0198 \)

\( P(\text{COVID} \mid +) = \dfrac{(0.99)(0.01)}{0.0198} = 0.5 \)

How can we relate this simulation to naturally occurring information flows on social media platforms?

Rational herding.

In a social learning environment, it is often rational for an individual to ignore their private information and follow the herd (i.e. adopt the beliefs and actions of those they observe).

What is Reddit?

Where does its content come from, and how do users interact with it?

What do you know about the subreddit community r/wallstreetbets?

What makes retail investors, like those on r/wallstreetbets, more vulnerable to herding effects?

What biases in judgment may be driving these herding effects?

Motivated Reasoning.

A cognitive process in which justification is provided for the individual's preferred outcome, despite the presence of contradictory evidence.

Is there a policy-oriented solution to dissuading r/wallstreetbets members from pursuing extremely high-risk trading?

How would you nudge individuals using the alternative logics of r/wallstreetbets to make better investing decisions?

Key Takeaways.

Incorrect information cascades can be the result of:

- Rational Herding.

- A rational means of synthesizing various information.

- Motivated Reasoning.

- A behavioural means of supporting a preferred outcome.

Either can lead groups to incorrect beliefs despite many individuals being presented with correct information.