Behavioural Economics

Agenda

- Introduction of Behavioural Finance (cont.)

- Case: Behavioral Finance at JP Morgan.

| Speed | Annie Zhang | Sabrina Wen | David Xie | Emily Peng | Max Livingston | Mathilde Hamoir |

| Knowledge | Firuza Huseynova | Chloe Macklin | Amy Liu | Ben Horwitz | Joseph Kan | Parker Ford |

| Confidence | Fahd Shahzad | Ranjodh Gill | Lindsay Zou | Gabby Lam | Jack Thompson | Triston Li |

| Courage | Michael Samoilov | Rohan Kumar | Alina Ramji | Aryan Mehra | Bhumi Naik | Yixuan Zhao |

| Insight | Sonia Narang | Jonathan Kent | Kristen Nessim | Asdaq Paracha | Konrad von Schoenberg | |

| Wisdom | Vincent Bonus | Elaine Yin | Paul Zhang | Josh Chua | Tesneem Rahhal | Brett Gugel |

| Energy | Mateo Murr | Alexander Yang | Andrew Cronin | Cadan Woolstencroft | Jordan Bloom | Kieran Bovingdon |

| Strength | Grace Solylo | Gabor Simon | David Esposto | Erik Ohrling | Gabe Pereira | Jade Chen |

How do 401(k)s, or Registered Retirement Savings Plans, typically work?

How might people make behavioural mistakes with this sort of plan?

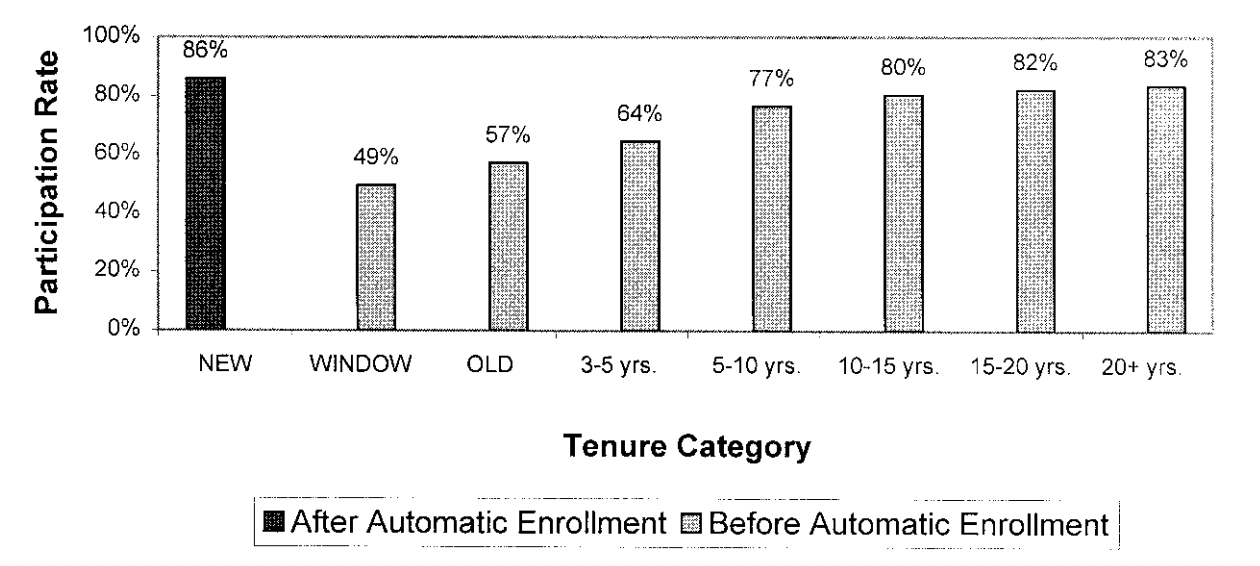

Brigitte Madrian discovered one mistake. Her study:

- Employer matched up to 6% of income.

- Match: $\$0.5$ for each $\$1$ contributed.

She used a natural field experiment.

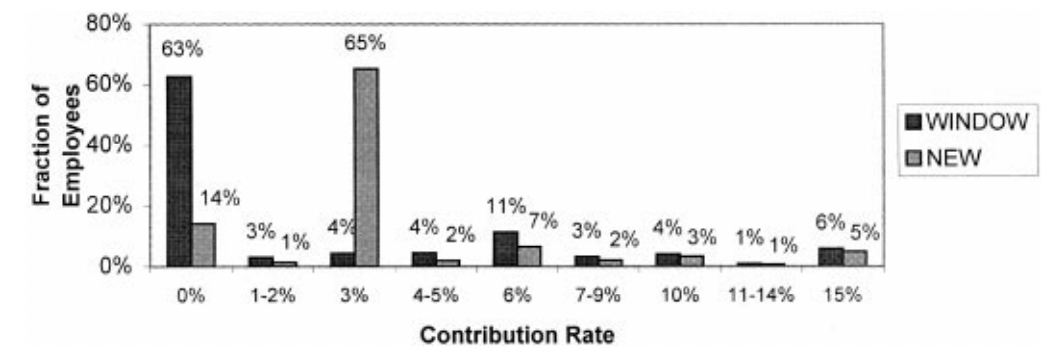

- 50% of employees were automatically enrolled @ 3%.

- 50% could enroll on request after one year.

- Enrollment and contribution decisions were easily changeable (when available).

What is the issue here?

What does this teach us about choice architecture?

Default effect.

The tendency for individuals to avoid making an active choice by accepting the default option selected on their behalf.

The default effect is one of the most powerful tools in all of microeconomics.

Task.

Flip a (virtual) coin 20 times and record the results as a sequence of "H"s and "T"s.

Meet Freddy.

Freddy is an investor who is interested in predicting the price of Stock X. He has developed a sophisticated financial model that reveals to him the chances of Stock X increasing/decreasing in value is 50% in any given year. Moreover, his model tells him the price is will either rise or fall by 20% over this time period.

For the last five years the price has always gone up. Consequently, he has chosen not to invest in Stock X, and says to you "there is no way the stock continues to increase in value again this year".

What mistake is Freddy making?

The Gambler's Fallacy.

The false belief that in a sequence of independent draws from a distribution, an outcome that has not occurred for a while is more likely to come up on the next draw.

This fallacy falls under the representativeness heuristic.

Let's check your coin flips...

Given Freddy's susceptibility to the gambler's fallacy, how would you coach him on improving his investment strategy?

What does traditional finance theory believe is true about investor rationality?

What are the behavioural strategies JP Morgan managed?

How well did these strategies perform?

What patterns in stock returns did Complin and his team find?

What biases did they attribute the patterns to?

Do you think modern investing technologies (e.g. data, computational power) exacerbate or attenuate the impact of these biases?

Richard Thaler's advice on investing.

- "Don't try this at home."

- “My lazy strategy of doing very little, buying mostly stocks and then not paying attention has served me well.”

- Thaler is a partner at Fuller & Thaler Asset Management, and believes beating the market with any model is only achievable among the few with professional-level resources.