9483

AiS

Session 1a

Joshua

Foster

Agenda

First 80-ish minutes:

- Introduction to the Course.

- MobLab Simulation: Double Auction Market.

- Case: Hurricane Sandy: Supply, Demand and Appropriate Responses to the Gas Shortage.

Second 80-ish minutes:

- Quick Case: Pricing a Drink for Value Creation.

- Marginal Analysis for Profit Maximization.

- Maximum Price Heuristic.

About Me

Joshua Foster, Ph.D.

- Feel free to call me Josh.

- I do research in Psychology and Economics.

- I specialize in firm competition.

I am always happy to help!

- Email me at jfoster@ivey.ca.

- Office Hours are Thursday, 3:00-4:30 PM.

- Also available by appointment.

This is a managerial economics course infused with behavioural insights. Topic areas include:

- Price discovery, pricing strategy, and consumer preferences.

- Market creation, failures and the role of government.

- Market design through the lens of behavioural economics.

Our goal is to develop an essential library of economic heuristics.

- Insert economic thinking at the center of each decision node within an organization.

- Identify the key incentive primitives of a given environment.

- Predict market dynamics and optimize relevant decision making.

Course Implementation

Evaluations & Assessments

|

Class contribution |

30% |

|

Midterm examination (October 8 from 3:00PM-6:00PM) |

25% |

|

Final examination (During elective period exams) |

45% |

|

|

100% |

Questions?

Simulation instructions.

- The situation: there is a market for oranges in which this class will act as Buyers and Sellers.

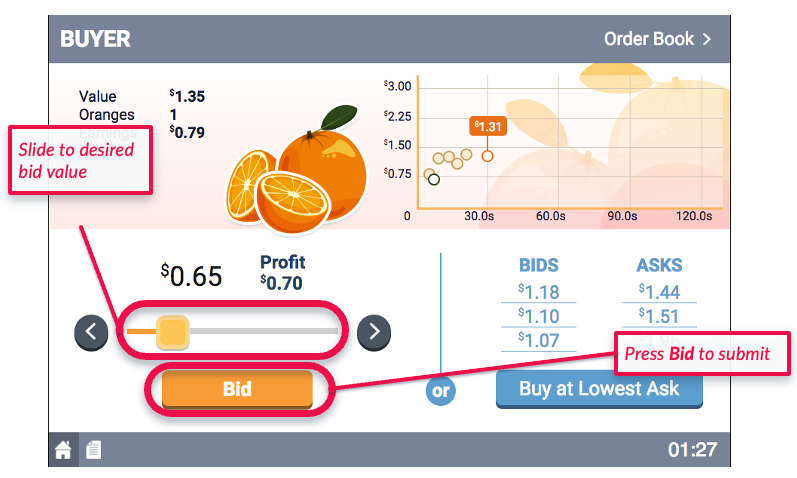

- What you do: make trades by negotiating on prices.

- Your objective: make trades in a way that maximizes your personal return.

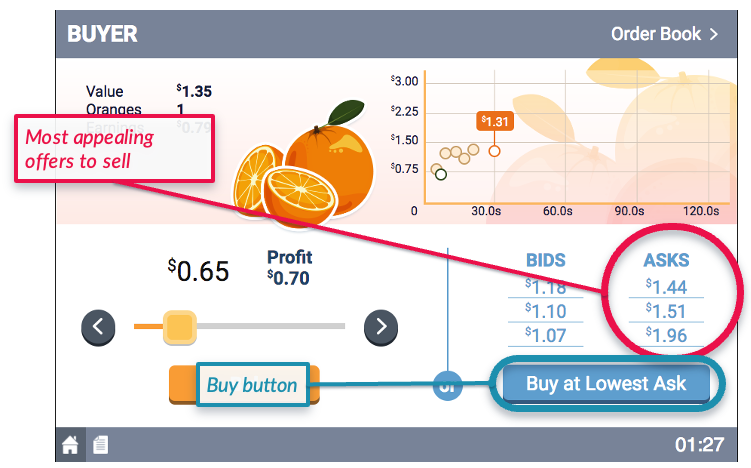

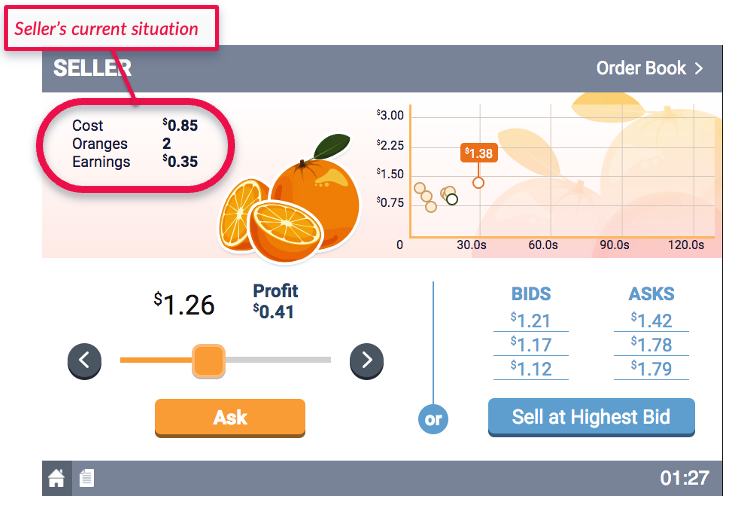

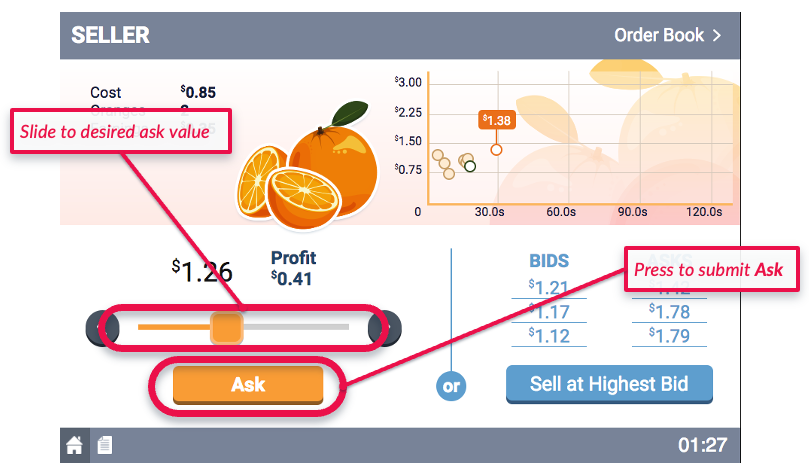

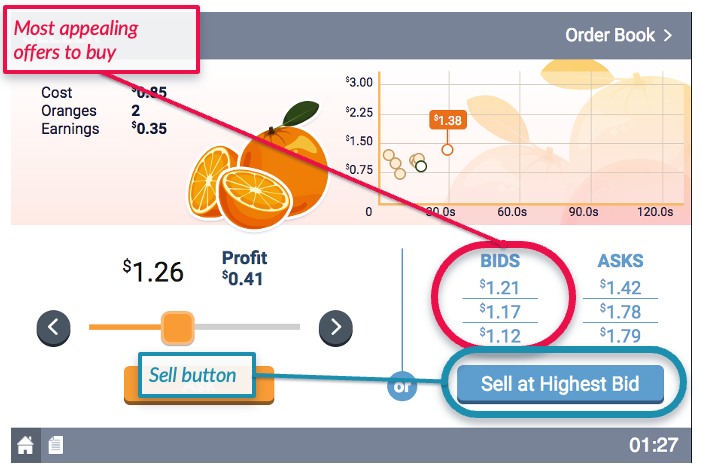

How it works.

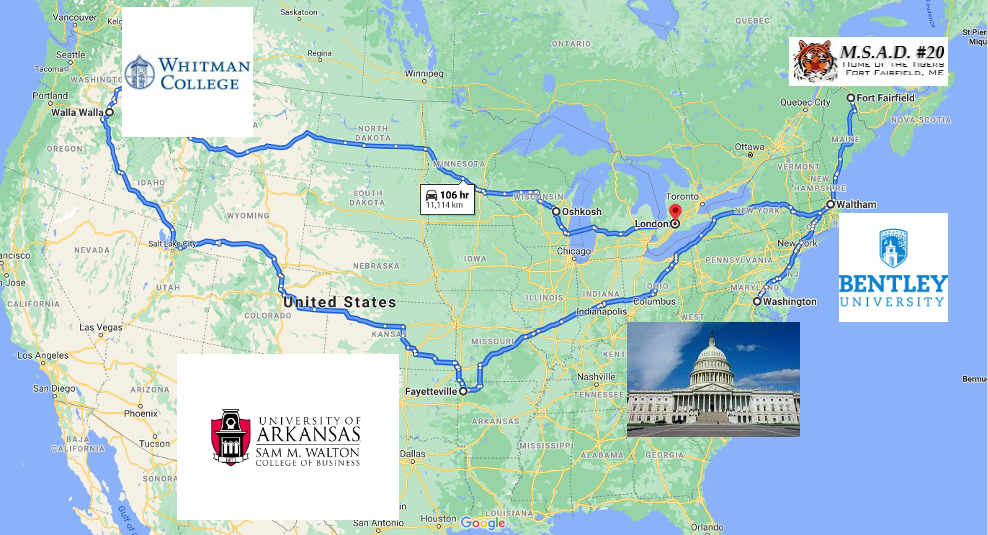

- Everyone is randomly placed in groups of 10.

- Within each grouping, each person is randomly assigned the role of either a Buyer or a Seller.

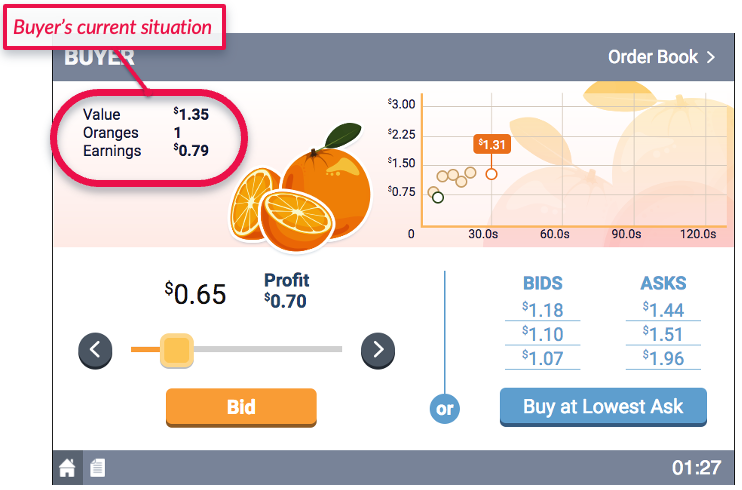

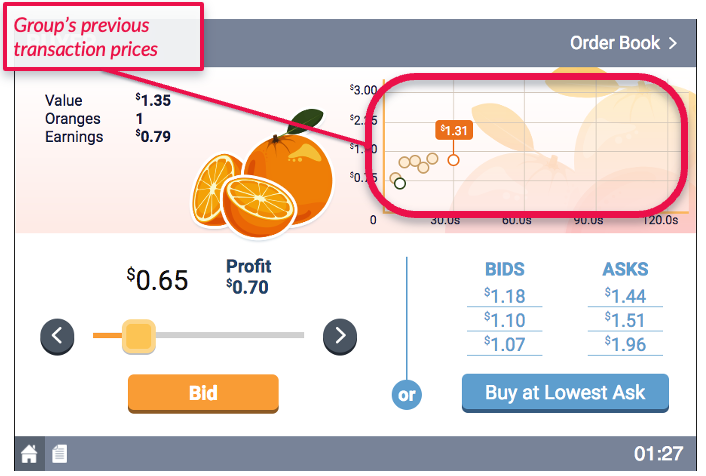

- The Buyers will make open bids, representing the prices at which they are willing to buy an orange.

- The Sellers will make open asks, representing the prices at which they are willing to sell an orange.

- Whenever the simulation finds a bid$\geq$ask in the market, it will execute the trade.

How do I decide my prices?

- The Buyers will have induced values for the oranges. That is, Buyers will be told the maximum they are willing to spend on a given orange.

- Likewise, the Sellers will have induced costs for the oranges. That is, Sellers will be told the least they are willing to accept for a given orange.

How you "win".

- The Buyers are seeking to maximize their consumer surplus (cs). That is,

$\text{cs}=\text{value of orange}-\text{price paid}\;$ for each transaction. - The Sellers are seeking to maximize their producer surplus (ps). That is,

$\text{ps}=\text{price received}-\text{cost of orange}\;$ for each transaction.

Questions?

What was your pricing strategy?

Market equilibrium.

The price that ensures buyers and sellers want to buy/sell the same quantity (i.e. their market incentives are aligned).

Absent an externality, this is the socially optimal outcome.

Quick summary of the case...

What non-price factors are influencing Demand? Supply?

| Demand | Supply |

| 1) | 1) |

| 2) | 2) |

| 3) | 3) |

Should gas prices be allowed to adjust to equilibrium?

What non-market (i.e. non-price-based) mechanisms might we consider?

What process would you use to determine prioritization (if any)?

Key takeaways.

- When shortages arise, it is because the market price is operating below its equilibrium.

- Deliberately setting a binding price ceiling does not necessarily promote equity across various societal groups - it is a task that requires care and economic insight.

- If the objective is to protect vulnerable members of a population, it will often be worthwhile to operate through an extra-market mechanism, rather than interfering with the market directly.