9483

AiS

Session 4b

Joshua

Foster

Agenda

- Irrational Preferences in Finance

- The Fourfold Pattern of Risk Attitudes

- The Representativeness Heuristic

Reference-dependent preferences cause irrational behaviour.

Consider an investor with the value function:

Normalize wealth to $w=0$ and reference point to $r=0$.

$$ V(w, r) = \begin{cases} w-r & \text{if } w \geq r \\ 2(w-r) & \text{if } w < r \\ \end{cases} $$

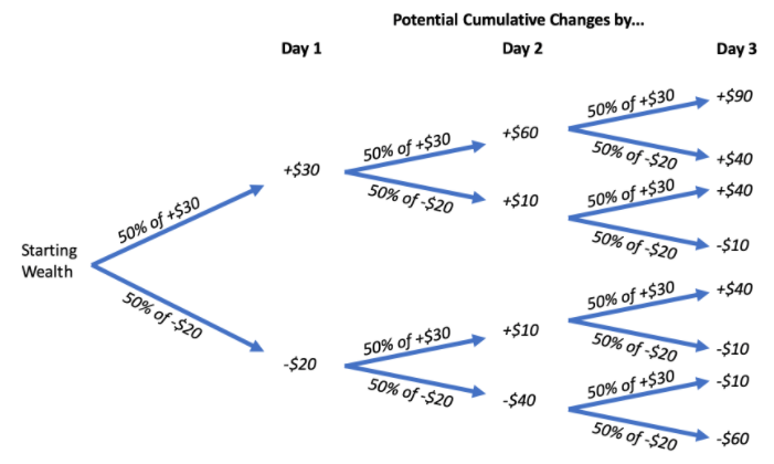

Investment opportunity:

- 50% chance at +$\$$30 return

- 50% chance at -$\$$20 return

Calculate their expected utility from this gamble.

$$ V(w, r) = \begin{cases} w-r & \text{if } w \geq r \\ 2(w-r) & \text{if } w < r \\ \end{cases} $$

Another investment opportunity:

- 12.5% chance at +$\$$90 return

- 37.5% chance at +$\$$40 return

- 37.5% chance at -$\$$10 return

- 12.5% chance at -$\$$60 return

Calculate their expected utility from this gamble.

Narrow framing discourages optimal investing.

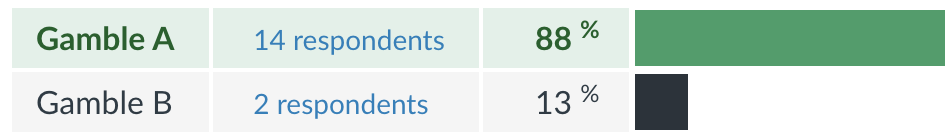

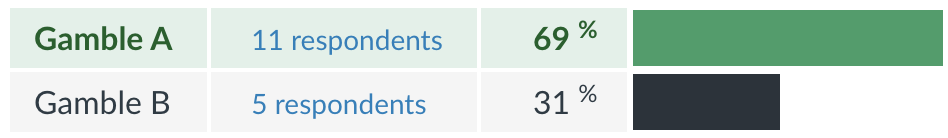

High Probability Gain

- $\$$800 for sure

- 80% chance @ $\$$1000

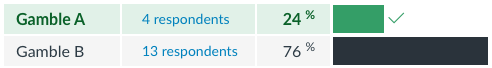

High Probability Loss

- -$\$$800 for sure

- 80% chance @ -$\$$1000

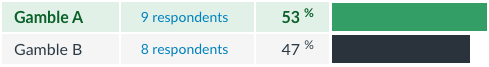

Low Probability Gain

- $\$$10 for sure

- 1% chance @ $\$$1000

Low Probability Loss

- -$\$$10 for sure

- 1% chance @ -$\$$1000

Reference-dependent preferences$+$Probability Weighting

$\Rightarrow$Fourfold Pattern of Risk Attitudes

High Probability Gain

causes risk-aversion

High Probability Loss

causes risk-loving

Low Probability Gain

causes risk-loving

Low Probability Loss

causes risk-aversion

Task.

Flip a (virtual) coin 20 times and record the results as a sequence of "H"s and "T"s.

Meet Freddy.

Freddy is an investor who is interested in predicting the price of Stock X. He has developed a sophisticated financial model that reveals to him the chances of Stock X increasing/decreasing in value is 50% in any given year. Moreover, his model tells him the price is will either rise or fall by 20% over this time period.

For the last five years the price has always gone up. Consequently, he has chosen not to invest in Stock X, and says to you "there is no way the stock continues to increase in value again this year".

What mistake is Freddy making?

The Gambler's Fallacy.

The false belief that in a sequence of independent draws from a distribution, an outcome that has not occurred for a while is more likely to come up on the next draw.

This fallacy falls under the representativeness heuristic.

Let's check your coin flips...

Given Freddy's susceptibility to the gambler's fallacy, how would you coach him on improving his investment strategy?

Richard Thaler's advice on investing.

- "Don't try this at home."

- “My lazy strategy of doing very little, buying mostly stocks and then not paying attention has served me well.”

- Thaler is a partner at Fuller & Thaler Asset Management, and believes beating the market with any model is only achievable among the few with professional-level resources.