9483

AiS

Session 9b

Joshua

Foster

Agenda

- Quick Case: Surge Pricing at Wendy’s: A Frosty Reception.

February 2024 Earnings Call: Wendy’s CEO, Kirk Tanner, said in 2025 the restaurant would "begin testing more advanced features like dynamic pricing."

- Tanner's remarks created a stir among customers and politicians.

- Wendy’s needed to issue a clarifying statement on its pricing strategy.

What is dynamic pricing?

How does dynamic pricing compare to price discrimination?

What makes Wendy’s value proposition distinctive in the fast-food market?

(i.e. where does the consumer surplus come from?)

Objective: Evaluate Wendy’s opportunity to use dynamic pricing in 2025.

- Consider the relevant economic tradeoffs, relative to static pricing.

- Use behavioural theory to explore potential consumer reactions.

- Identify the most likely response from competitors.

| Group 1 | Ishi Khamesra | Elisabeth Iannucci | Robert Gray | Cherry Qian | Adam Meadows |

| Group 2 | Bella Natasha Diego | Calvin Zehr | Jennifer Estrada | Alan Hwang | Dan Hicks |

| Group 3 | Chaitanya Gandhi | Michael Schumacher | May El Damatty | Sean Morris | Quoc Lap Nguyen |

| Group 4 | Kiera Treloar | Rio Baudisch-McCabe | Sangeetha Sambamoorthy | Sifan Wang | Aanal Patel |

| Group 5 | Silvia Pacheco Diaz | Kayla Vargas | Kendall Zhang | Aaditya Geed | Sam Macy |

| Group 6 | Princess Adeniran | Ramnik Minhas | Valentina Efionayi | Derek Adam | Mac Astritis |

| Group 7 | Josh Ge | Ishani Adityan | Akber Amanulla Khan | Alice Wu | |

| Group 8 | Iain Smith | Maro Egbedi | Angelita Martin | Judith Osemeke |

Small Group Task

In your assigned groups, take the next 15 minutes to reflect on the In-class Assignment Questions posted to Learn for this quick case.

Be prepared to discuss your responses to these questions when time is up.

Do you think Wendy’s should use dynamic pricing at all?

What is the economic argument for why dynamic pricing could improve Wendy’s profitability?

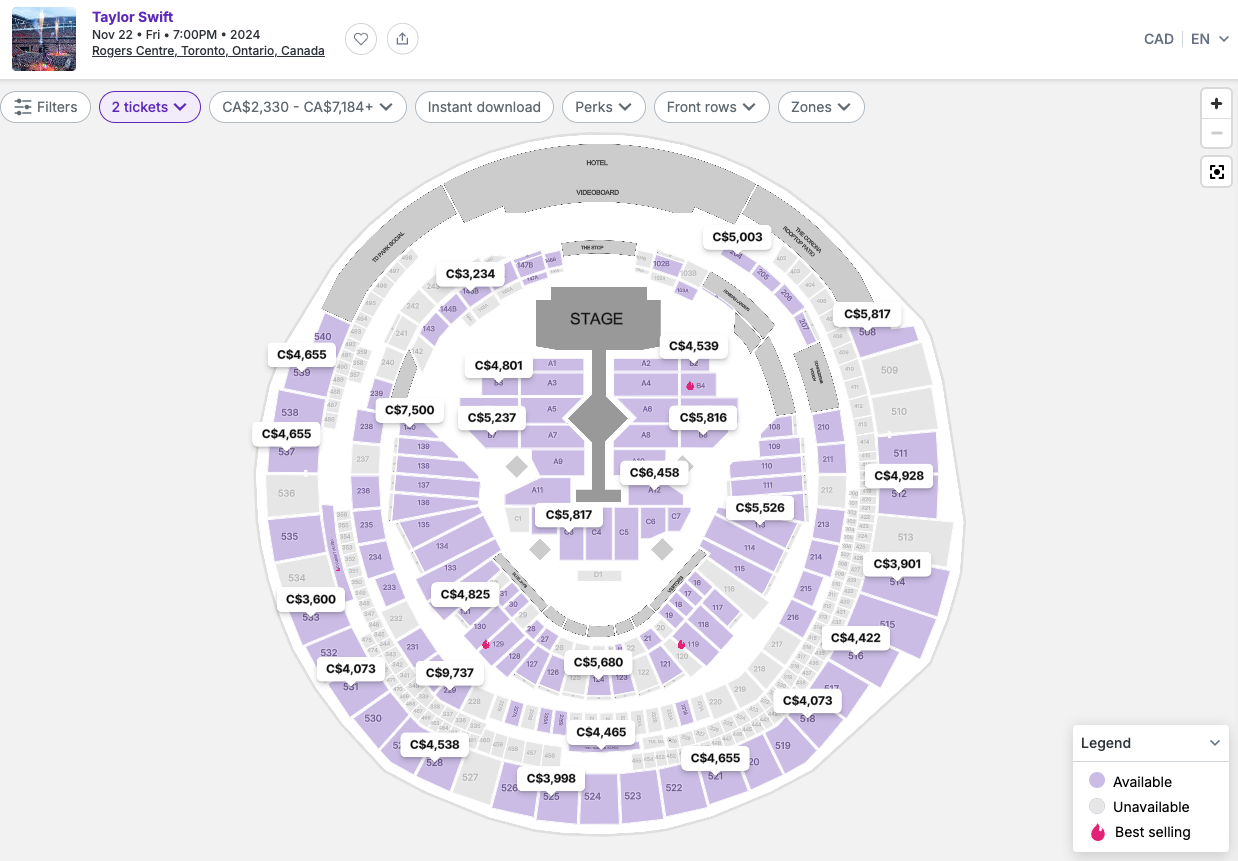

Where do we typically see dynamic pricing?

Surge Pricing.

A rapid increase in price that can be the result of a sudden increase in demand, decrease in supply, or the removal of pricing constraints (e.g. price ceilings).

“What do we want?”

— Justin Wolfers (@JustinWolfers) January 3, 2014

SURGE PRICING

“When do we want it?”

IN LONG-RUN EQUILIBRIUM#ASSA2014 pic.twitter.com/ugGx0HK0Ks

My friend was charged 18K for a 20 Min ride (!), and they are sticking to it. What in the world??? This is insane! @Uber_Support @badassboz @Uber pic.twitter.com/RjFihVLKIC

— Emily Kennard (@emilykennard) December 9, 2017

Why would Wendy’s proposed strategy be accused of surge pricing? Is this a fair accusation?

What relevant behavioural considerations did you identify among consumers?

How do they influence Wendy’s pricing strategy?

What does Wendy’s need to do to manage the fallout (if any) among consumers?

How do you anticipate Wendy’s competitors will respond to dynamic pricing?

Will dynamic pricing eventually become normalized in the AI era?

Firms like Wendy’s must account for non-price factors.

- Distributional social preferences when comparisons to others are relevant.

- Reference points and loss aversion when comparisons to expectations are relevant.

Standard economic models will under-estimate the influence of these preferences on market outcomes.