Global Economy, Markets and Strategy

Agenda

- MobLab Simulations: Bidding in Auctions.

- Case: Auction Vignettes (Parts A and B).

- Optimal Bidding Strategies.

- Stylized Facts on Auctions.

Where are auctions used most often?

| 1) | 2) |

| 3) | 4) |

| 5) | 6) |

Why don't these markets just post prices instead?

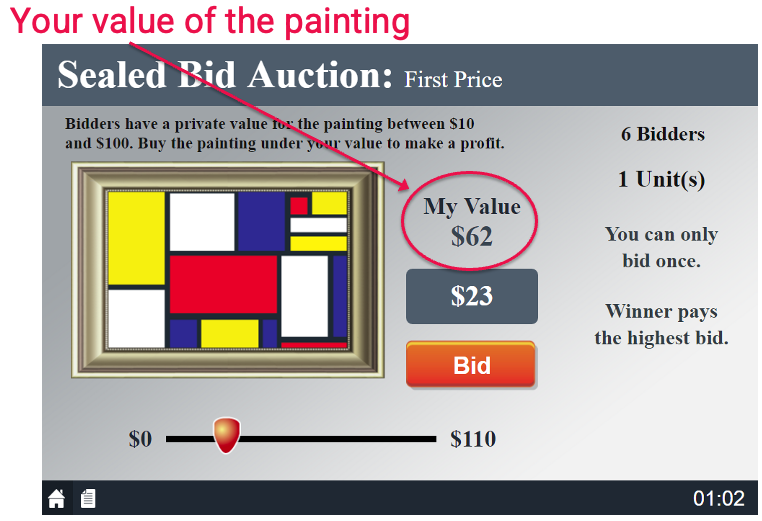

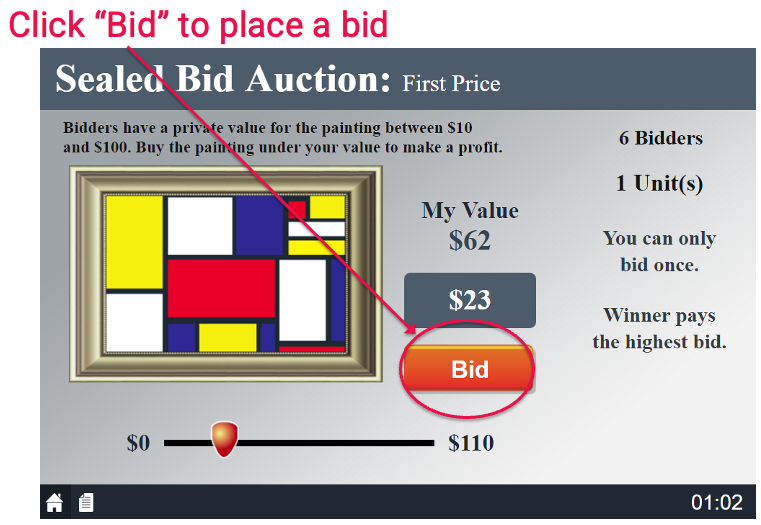

Simulation instructions.

- The situation: you and other bidders are in an auction for a painting.

- What you do: submit a sealed bid in an attempt to claim the painting.

- Your objective: win the painting with the largest profit possible.

How it works.

- Everyone is randomly placed in groups of 5.

- Each bidder will be randomly assigned a valuation for the painting somewhere between $\$$10-$\$$100.

- All bidders will simultaneously and privately submit bids to the auctioneer.

- The winner of the auction will be the individual in the group of 5 who bid the most for the painting.

"Payouts" are determined as:

$ \text{Profit} = \begin{cases} \text{Valuation} - \text{Bid} & \text{if won the auction} \\ 0 & \text{if lost the auction} \\ \end{cases} $

Questions?

What was your bidding strategy here?

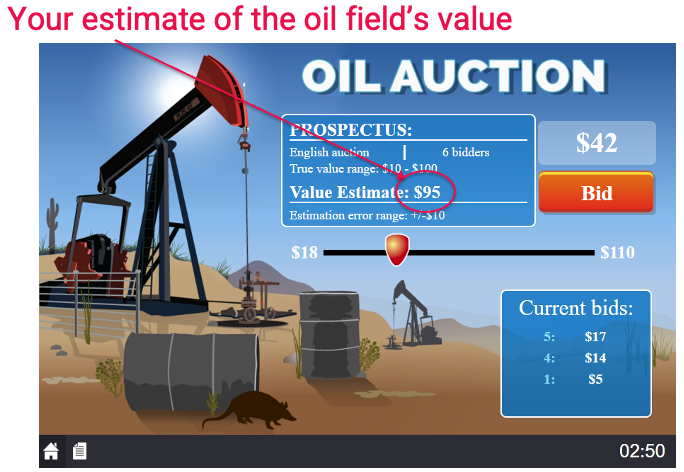

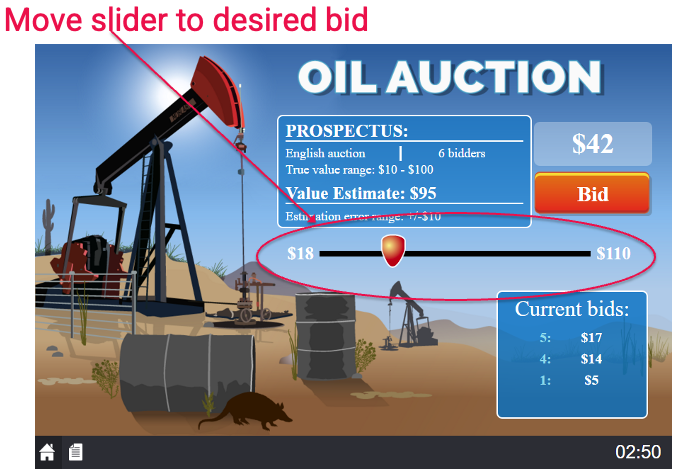

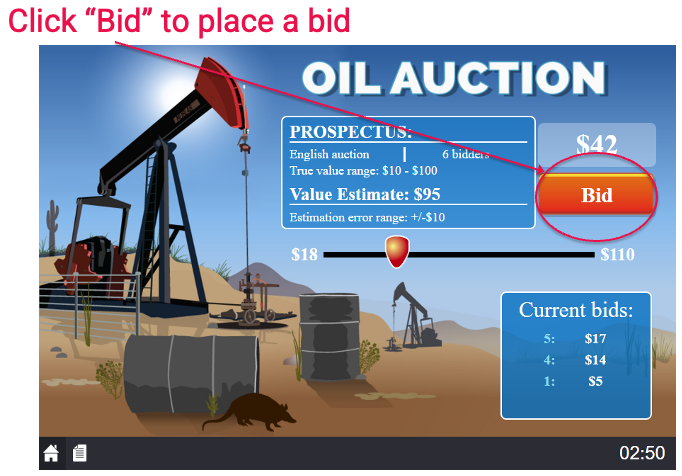

Simulation instructions.

- The situation: you and other bidders are in an auction for the oil rights of a field.

- What you do: submit an open-cry bid in an attempt to claim the oil field.

- Your objective: win the oil field with the largest profit possible.

How it works.

- Everyone is randomly placed in groups of 5.

- No one knows how much the oil field is worth (between $\$$10-$\$$100).

- Each bidder will receive a unique and private valuation estimate for the field.

- Each estimate will fall within $\pm$$\$$10 of the true value.

- Example: if you receive an estimated valuation of $\$$50, then you know the true value is somewhere between $\$$40-$\$$60.

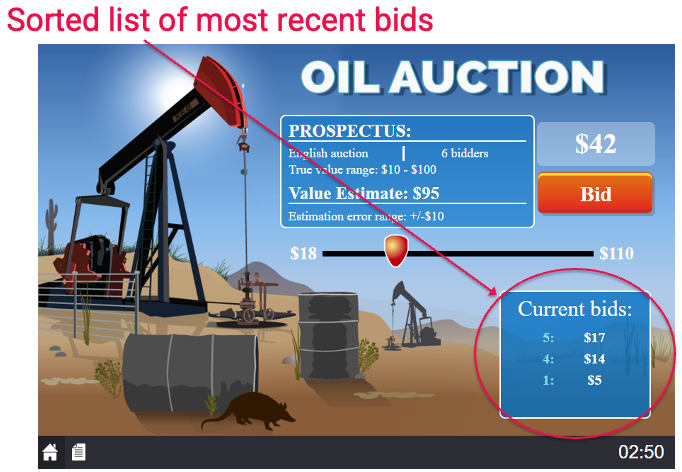

How bidding works.

- This auction uses open-cry bids.

- That is, bids are public and sequential.

- Bidding ends when time runs out (60s).

The winner of the auction will be the individual in the group of 5 who bids the most.

"Payouts" are determined as:

$ \text{Profit} = \begin{cases} \text{True Value} - \text{Bid} & \text{if won the auction} \\ 0 & \text{if lost the auction} \\ \end{cases} $

Questions?

What was your bidding strategy here?

How was this different from the first auction simulation?

In the first auction simulation.

- Bidders know their valuations.

- Bids are submitted without knowing what others are doing.

- The winner pays the most they are willing to bid.

This is known as a first-price sealed-bid private value auction.

Strategy for a first-price sealed-bid private value auction.

- Pretend as though your valuation is the greatest.

- What is the next highest valuation likely to be?

- Bid just enough to beat out that bidder.

In the second auction simulation.

- Bidders do not know their valuations.

- Bids are submitted knowing what others are doing.

- The winner pays the most anyone else is willing to bid.

This is known as a second-price open-cry common value auction (AKA an "English" auction).

Did anyone lose money in the oil field auctions?

The Winner's Curse

When bidders do not know the value of the item until after the auction is over, the winner often over-estimates its value, and thus pays more than it's worth.

Strategy for a second-price open-cry common value auction.

- Pretend as though your valuation is the greatest.

- What is the true value likely to be then?

- (Something less, due to the error in the signal.)

- Bid that estimation of the true value.

What kind of auction is the housing market?

What would happen if we switched to an English auction?

"So, Josh, what kind of auction should I use if I have to sell an item?"

Revenue Equivalence Theorem.

- If valuations are private and uncorrelated, and

- Bidders are risk-neutral, then

- It doesn't matter!

"No, but really, what kind of auction should I use?"

| Common Value Auctions | Private Value Auctions | |||||

|---|---|---|---|---|---|---|

| Potential collusion | No collusion | Potential collusion | No collusion | |||

| Risk averse bidders | First-price sealed-bid | English open-cry | Risk averse bidders | First-price sealed-bid | First-price sealed-bid | |

| Risk neutral bidders | First-price sealed-bid | English open-cry | Risk neutral bidders | First-price sealed-bid | English open-cry | |

Key takeaways.

- Auctions are an important allocation mechanism in many markets.

- While generally very useful, they sometimes cause problems, such as the Winner's Curse.

- Concerns regarding risk and collusion among bidders can sway the relative value of a given auction mechanism.