Global Economy, Markets and Strategy

Agenda

- Case: X Prize Foundation: Revolution through Competition.

- MobLab: R&D competition.

- Strategies for competing in contests.

- Mechanism design of contests.

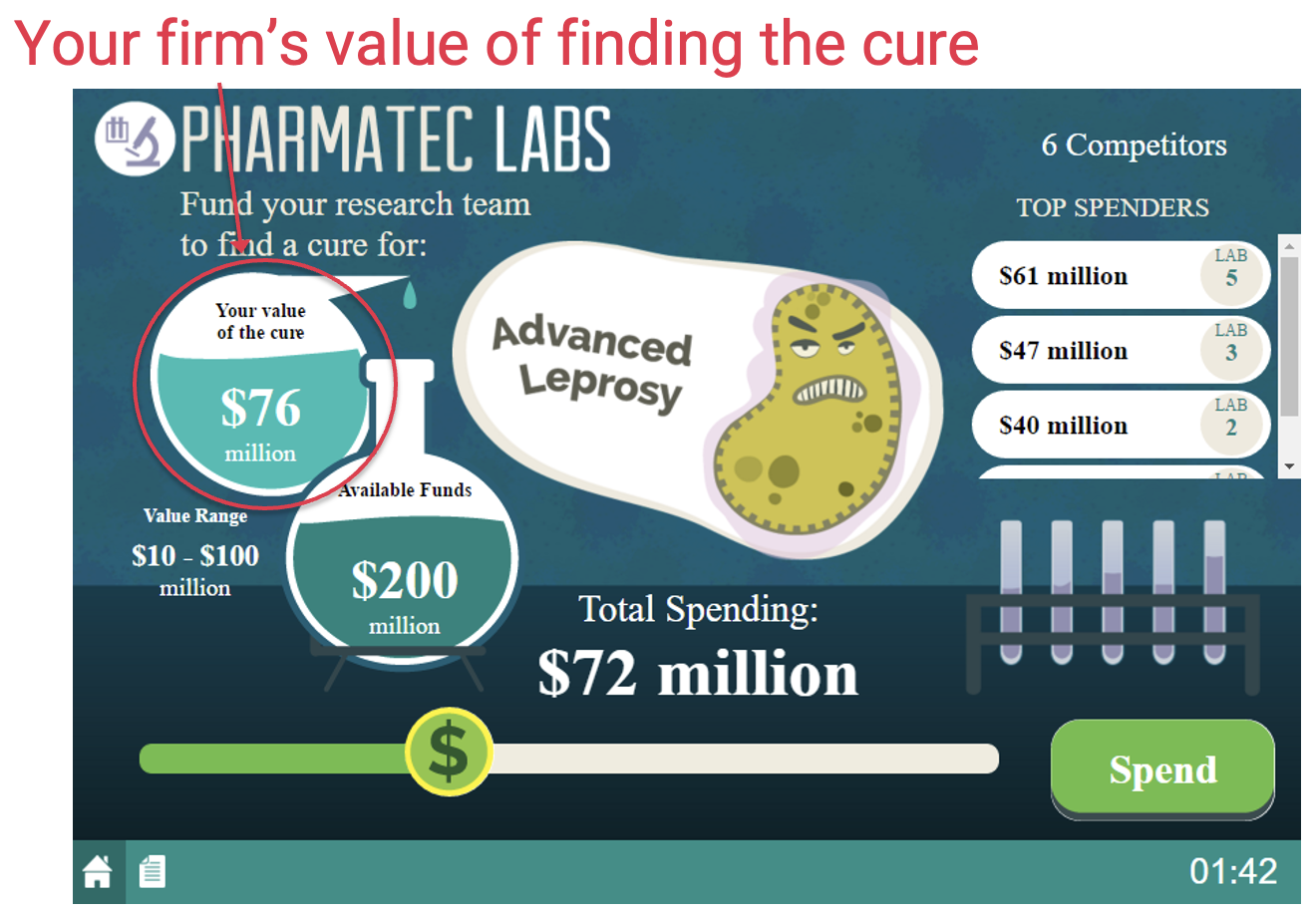

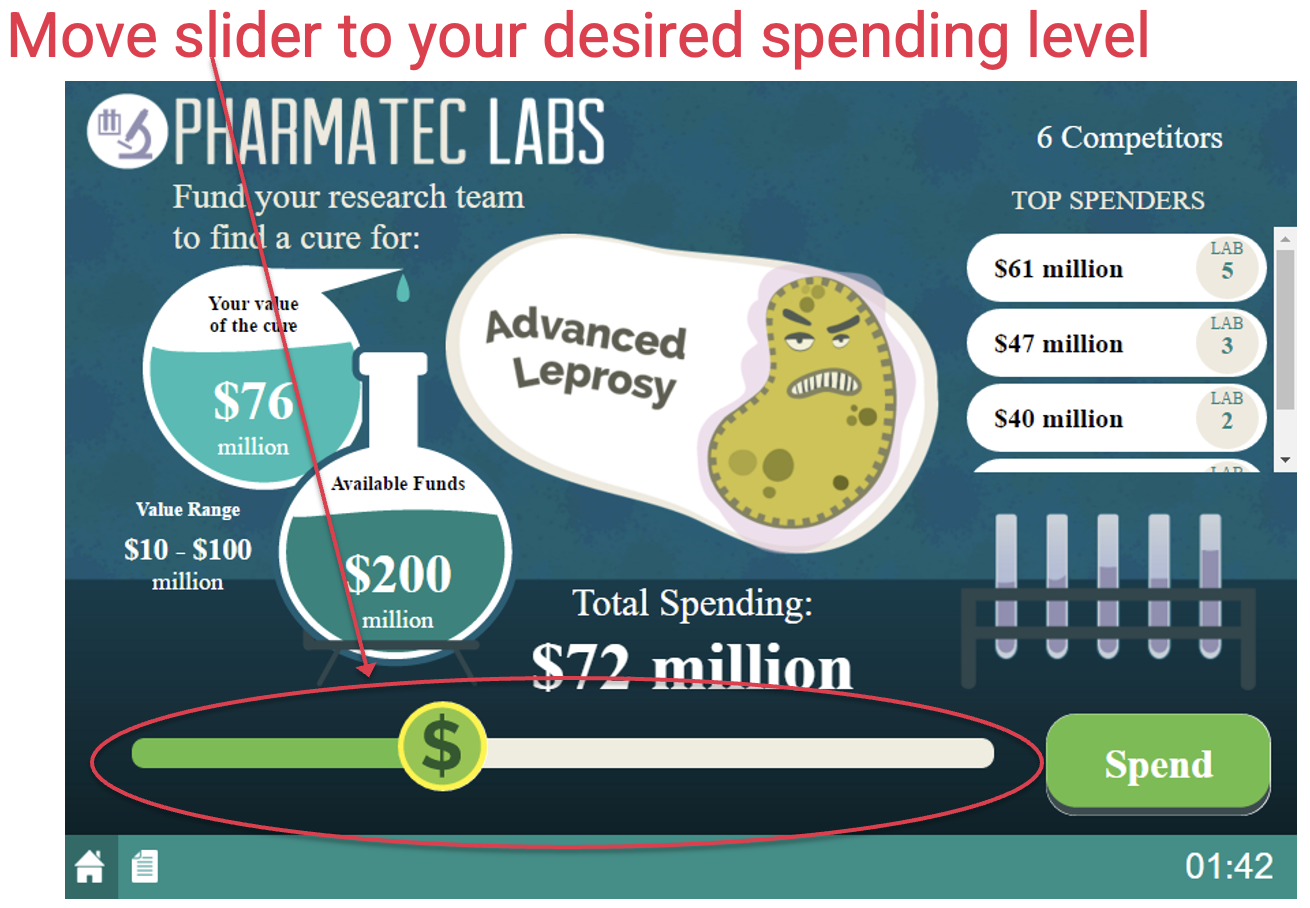

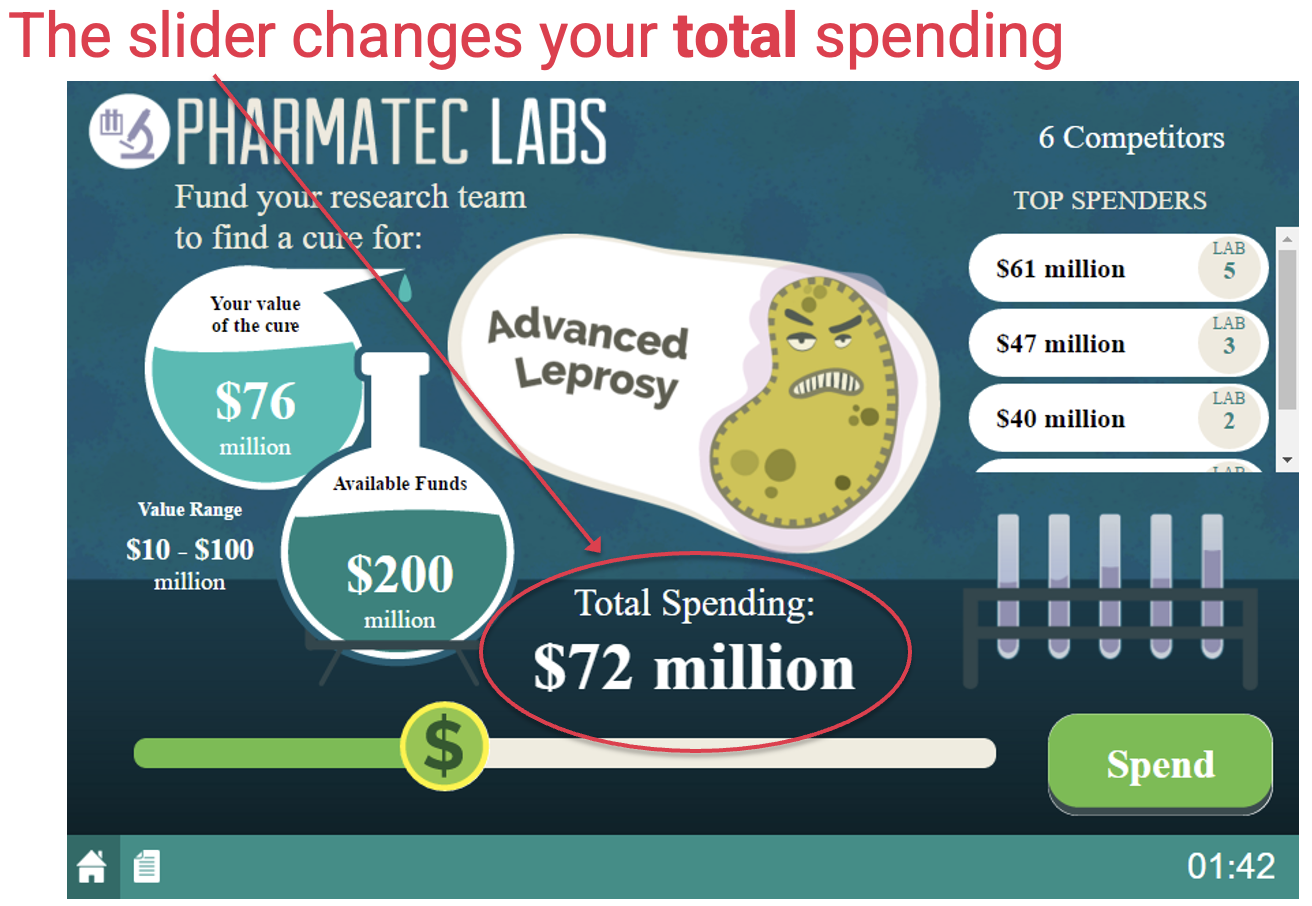

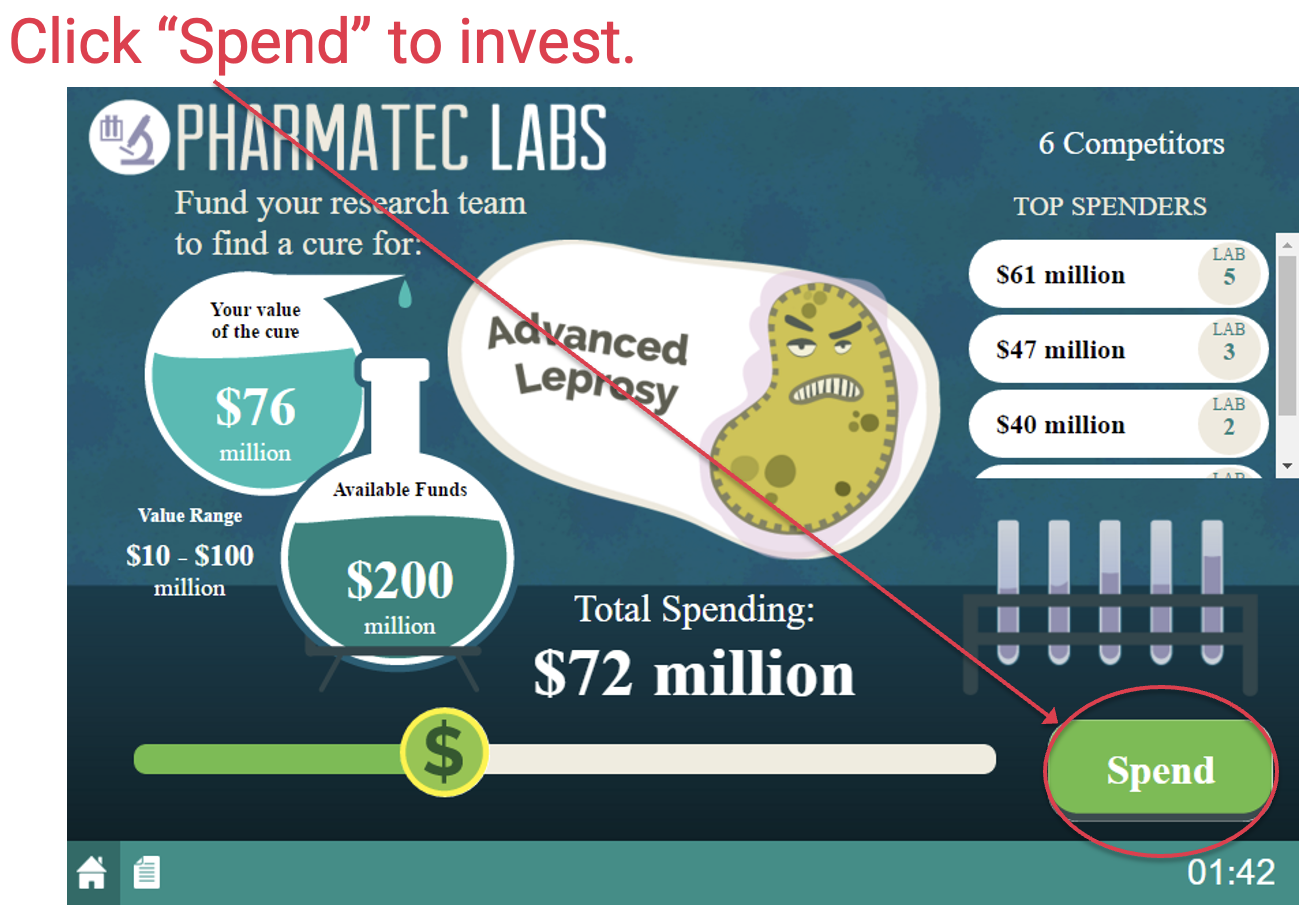

Simulation instructions.

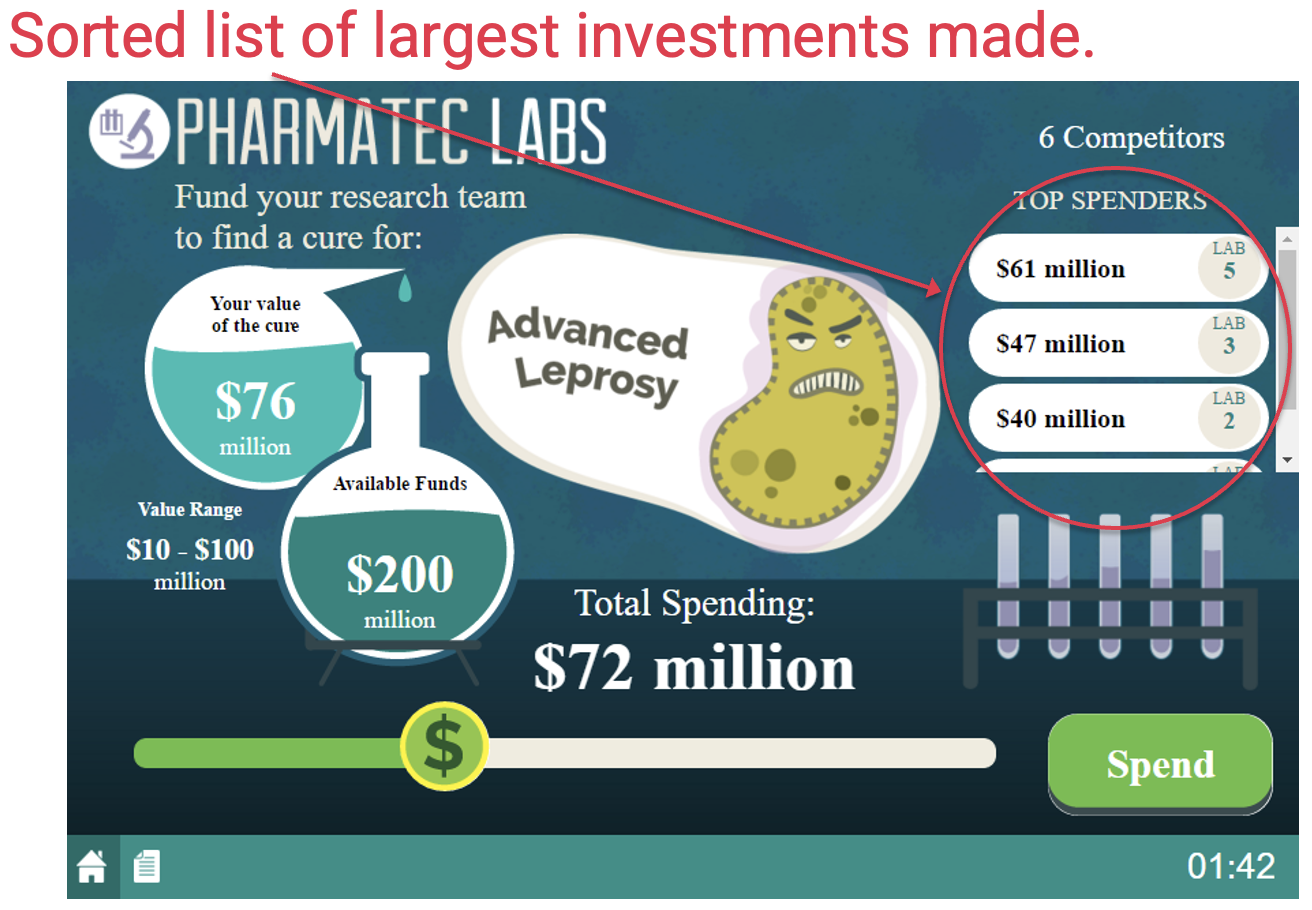

- The situation: there is a competition to cure a disease through R&D.

- What you do: make unrecoverable investments in an attempt to find the cure.

- Your objective: profit maximize by becoming the firm that discovers the cure.

How it works.

- Everyone is randomly placed in groups of 4.

- Within each grouping, each person (firm) is randomly assigned a value to winning the competition.

- Valuation will be drawn somewhere between 10 and 100.

- Investments are made publicly, like an open-cry auction.

- The person who makes the largest investment when time runs out wins.

"Payouts" are determined as:

$ \text{Profit} = \begin{cases} \text{Valuation} - \text{Investment} & \text{if won the competition} \\ - \text{Investment} & \text{if lost the competition} \\ \end{cases} $

Questions?

What was your strategy in this competition?

How does this type of competition compare to the auctions we studied last week?

War of Attrition.

A form of competition wherein participants make unrecoverable investments through time in order to claim some prize.

What environments require its participants to sink investments like this?

| 1) | 2) |

| 3) | 4) |

| 5) | 6) |

Is participating in these competitions rational? How does a rational competitor decide when to call it quits?

How do wars of attrition relate to the contests run by the X Prize Foundation?

Why do we need an X Prize? Why can't entrepreneurs just create the market through the innovation?

How can an all-pay contest like the X Prize influence an industry, even among those firms who lose or do not participate?

What happens when a contest is poorly designed? What was the example from the case?

How did the X Prize use its high visibility to its advantage, and how did this shape the incentive for firms to participate?

Diamandis: "We are basically a marketing, sponsorship, and public relations organization. Our job is to make heroes out of people competing for the prize. We give them a global stage."

What features were important to the X Prize rules, and how did they promote the objectives of the prize?

| 1) | 2) |

| 3) | 4) |

| 5) | 6) |

How did Diamandis ultimately end up financing the prize?

Would you argue the prize competition succeeded?

The case discusses additional competitions designed by the X Prize Foundation.

- Energy-efficient vehicles.

- Education.

- Genomics.

- Other goals in space exploration.

Breakout group discussion: what industry could benefit from the creation of its own "X Prize"? Why doesn't it use more traditional "financial engines" for investments? Broadly speaking, how would you design it?

Key takeaways.

- All-pay contests called Wars of Attrition are a form of competition that can be found in R&D, politics, market creation/share, and public goods problems.

- In the presence of a market failure, this form of competition can be leveraged to promote investments in innovation.

- Mechanism design considerations are critical to ensure the incentives of the competition align with the developments needed for new technologies.