Global Economy, Markets and Strategy

Agenda

- Case: Tesla Inc.: Strategic Partnerships for Growth.

- Vertical Integration & Double Marginalization Problems.

What sorts of partnerships do traditional car manufacturers (e.g. Toyota, Ford) rely on?

How has Tesla deviated from this traditional business model?

| 1) | 2) |

| 3) | 4) |

| 5) | 6) |

What are the primary benefits to Tesla for their relatively unique approach to partnerships?

What (dis)advantages does Tesla have by owning their own showrooms?

| Advantages | Disadvantages |

| 1) | 1) |

| 2) | 2) |

| 3) | 3) |

Is this a good idea for Tesla?

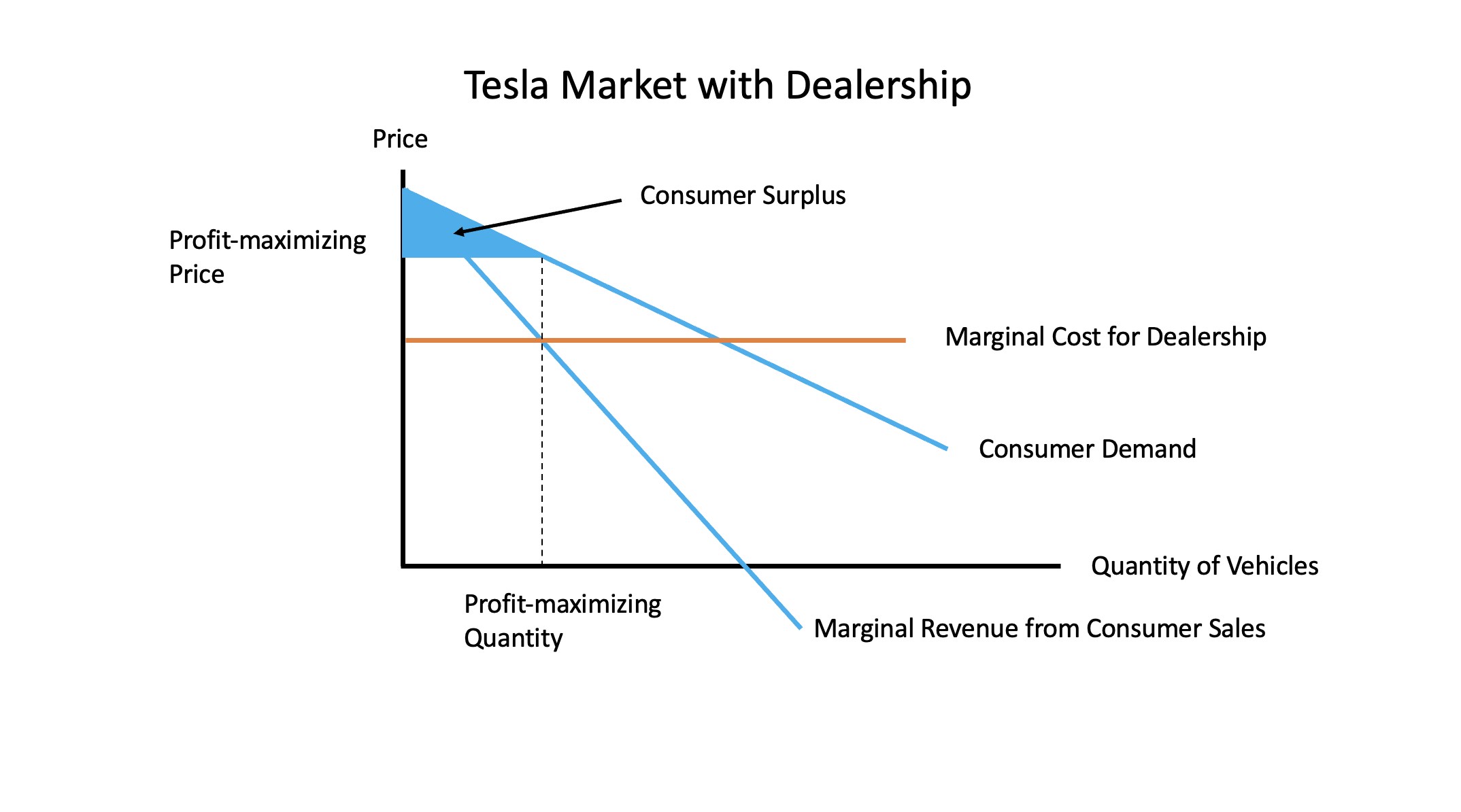

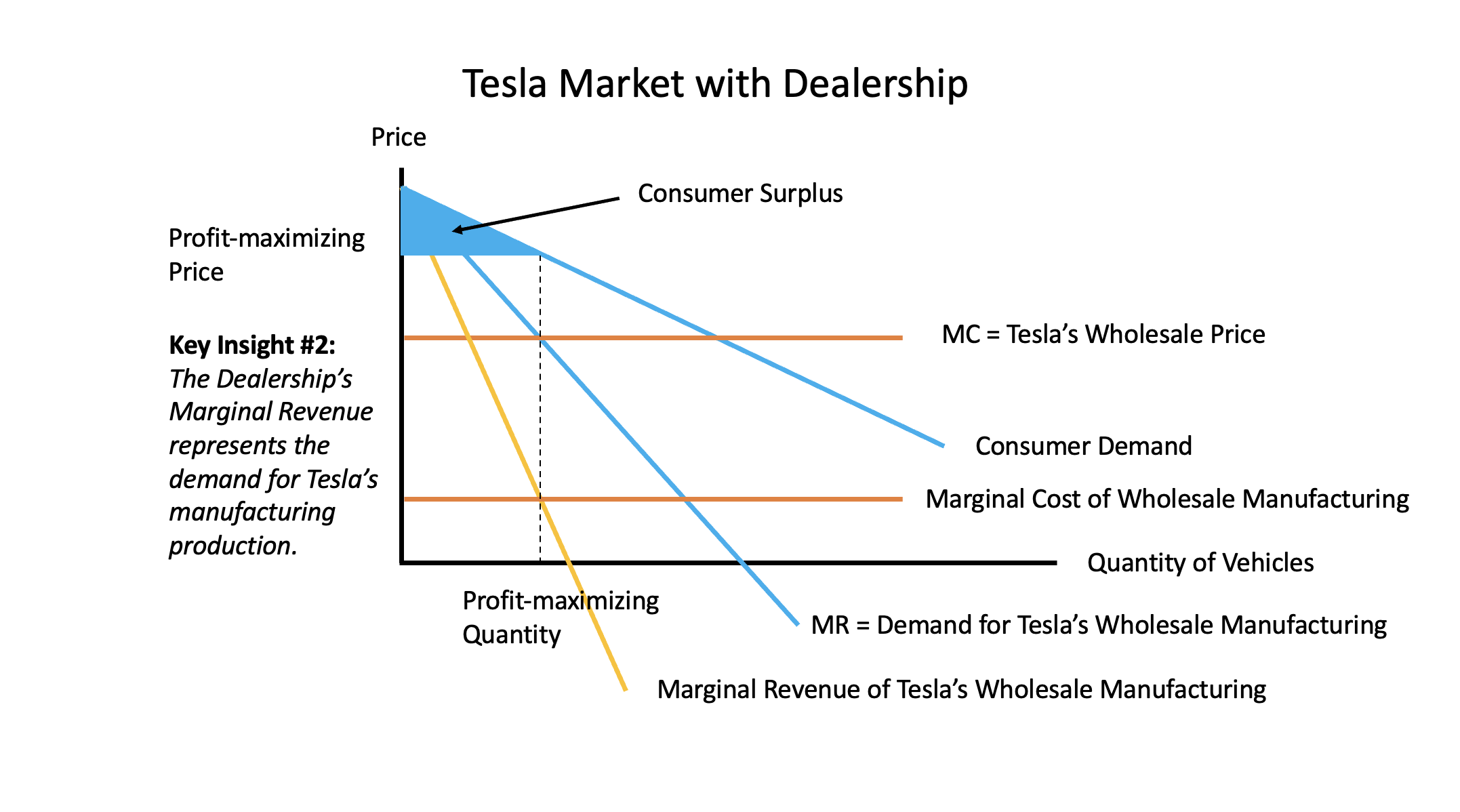

Tesla claims their consumers are better off as a result of operating their own showrooms.

- Who thinks this is true?

- How would an economist want to measure a claim like this?

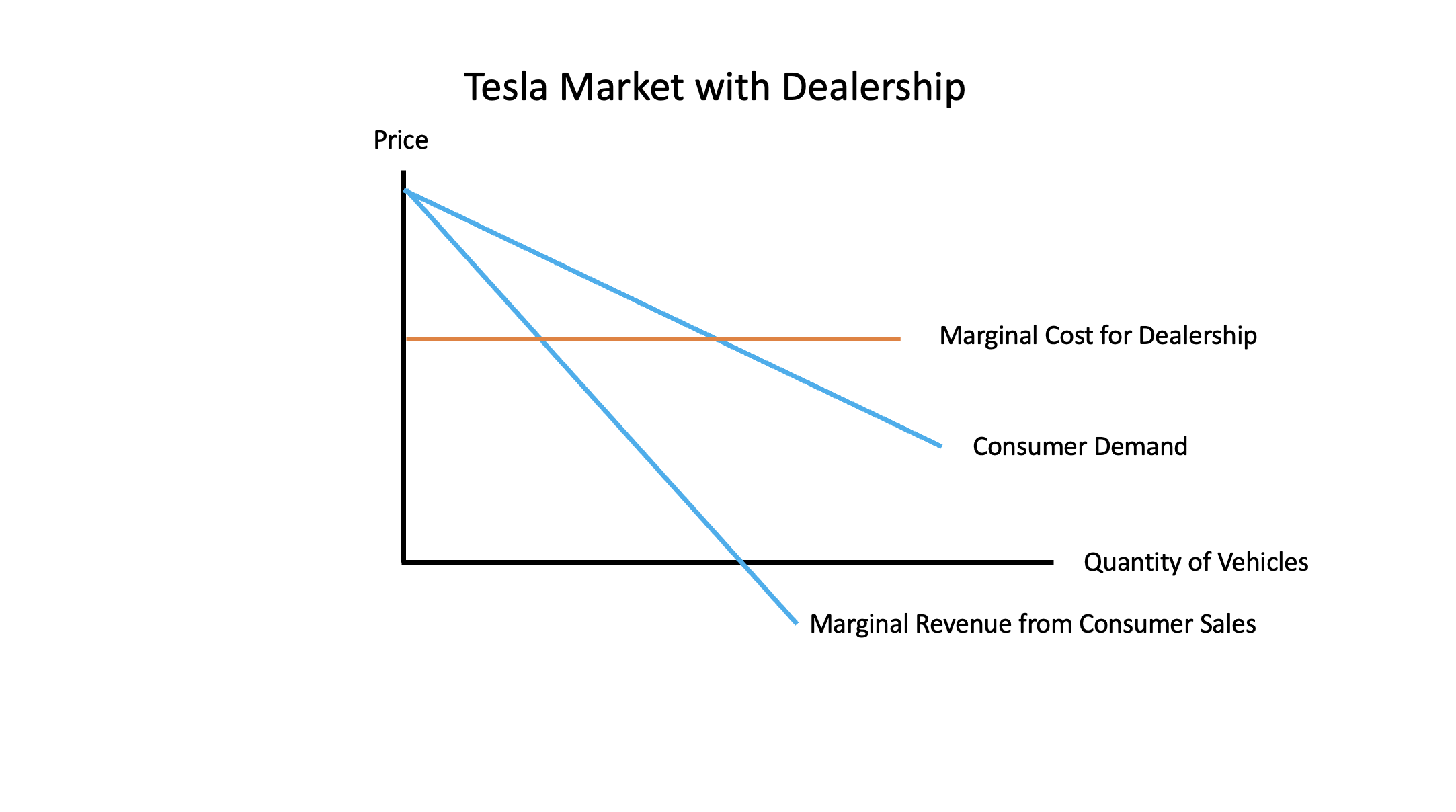

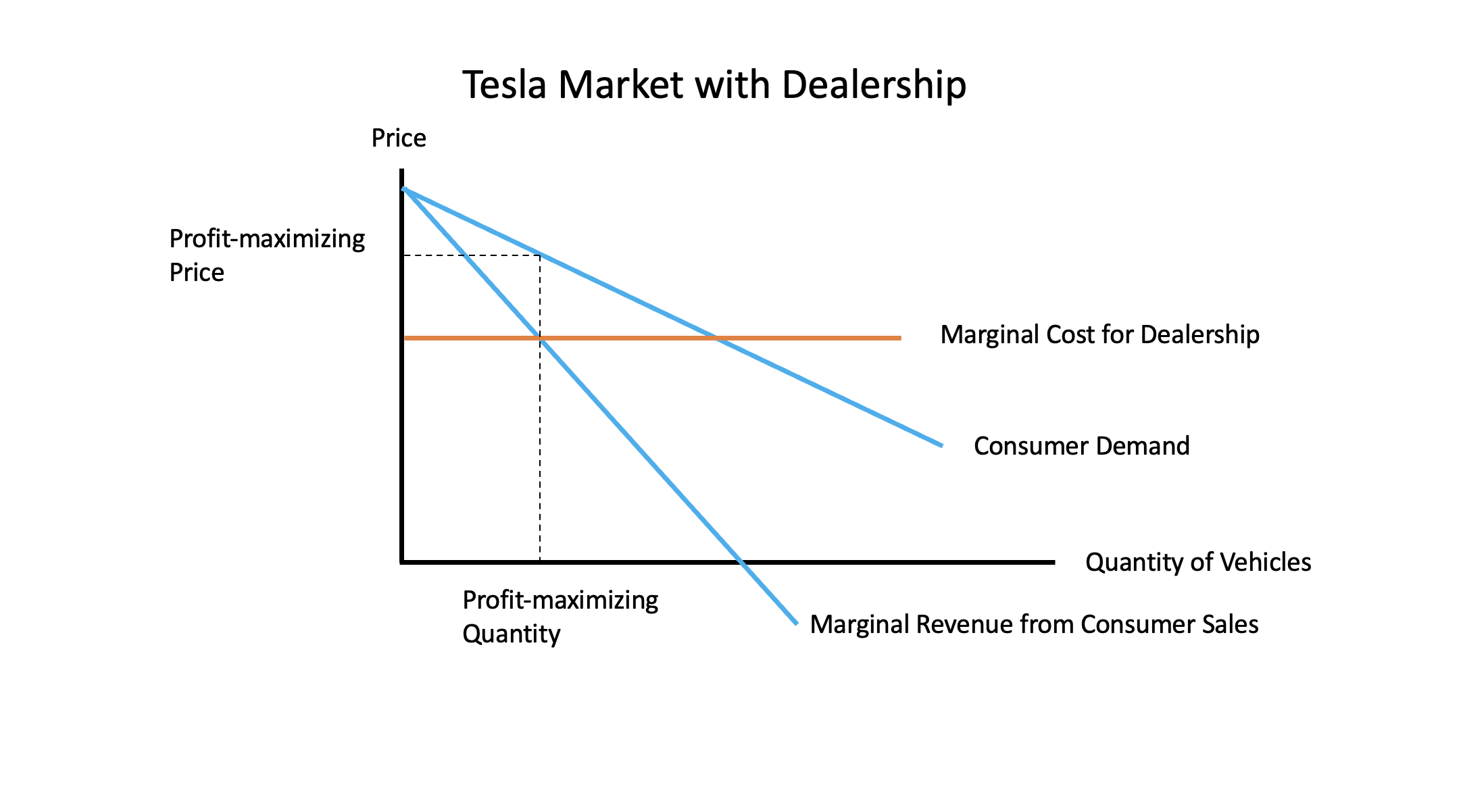

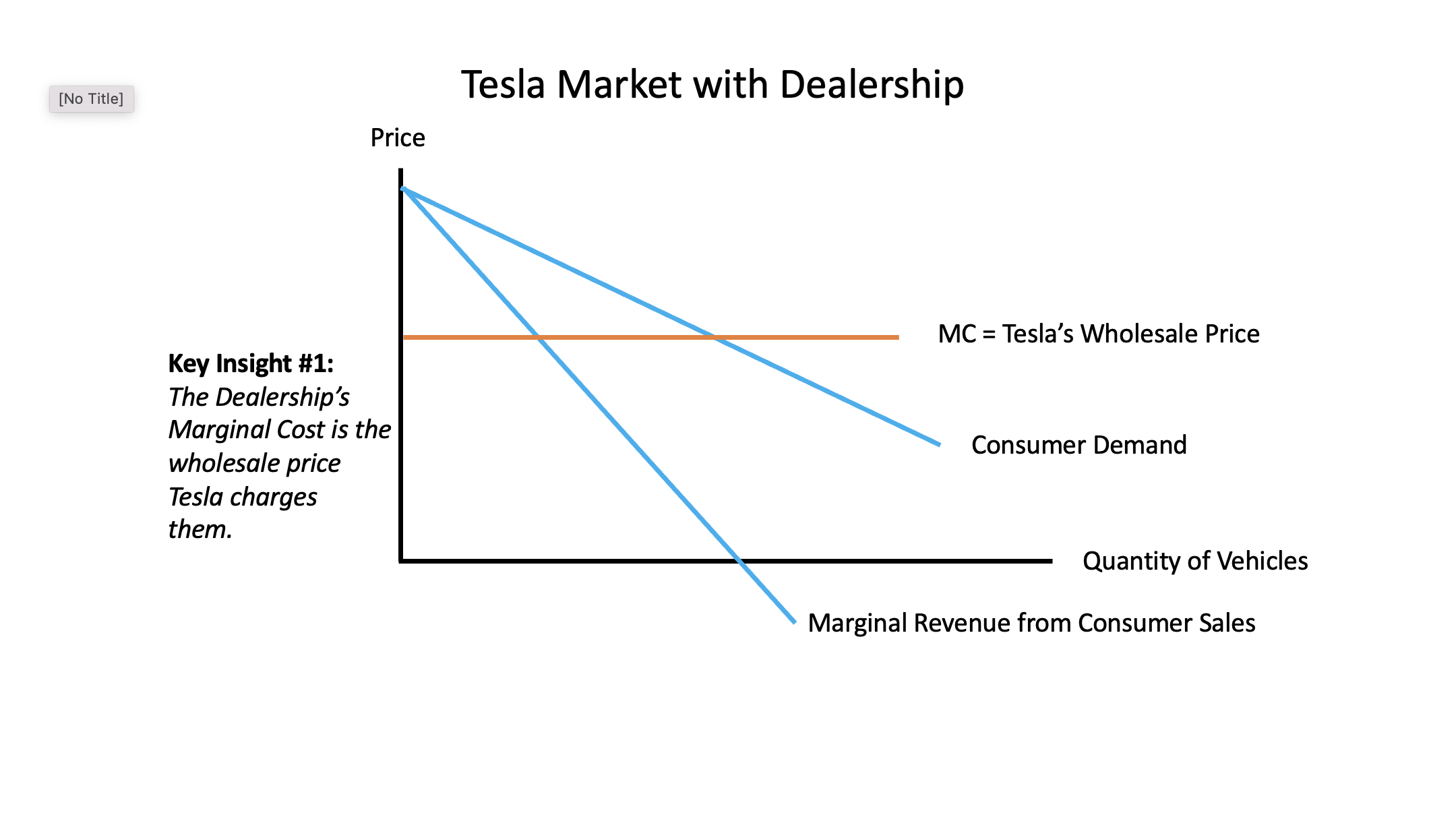

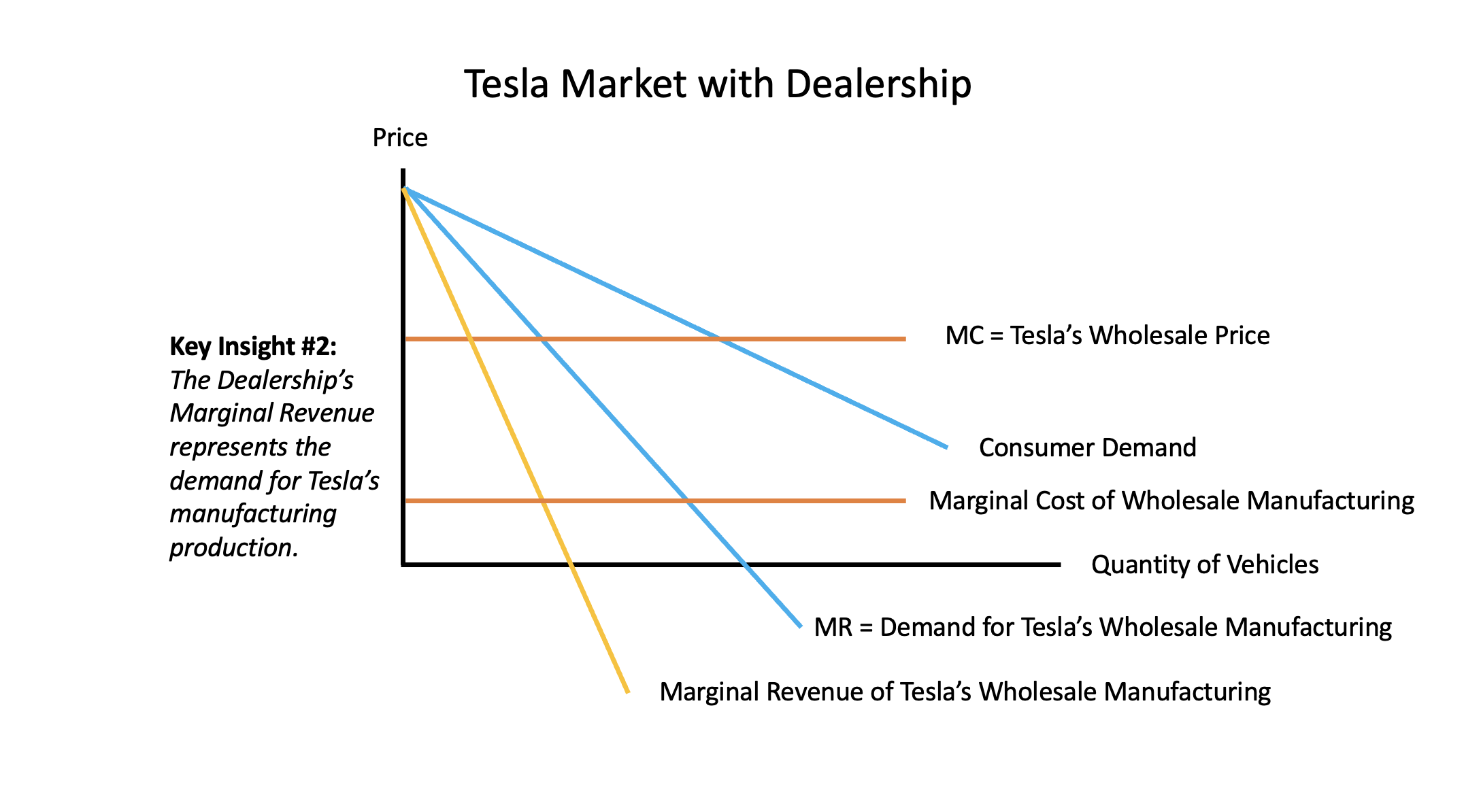

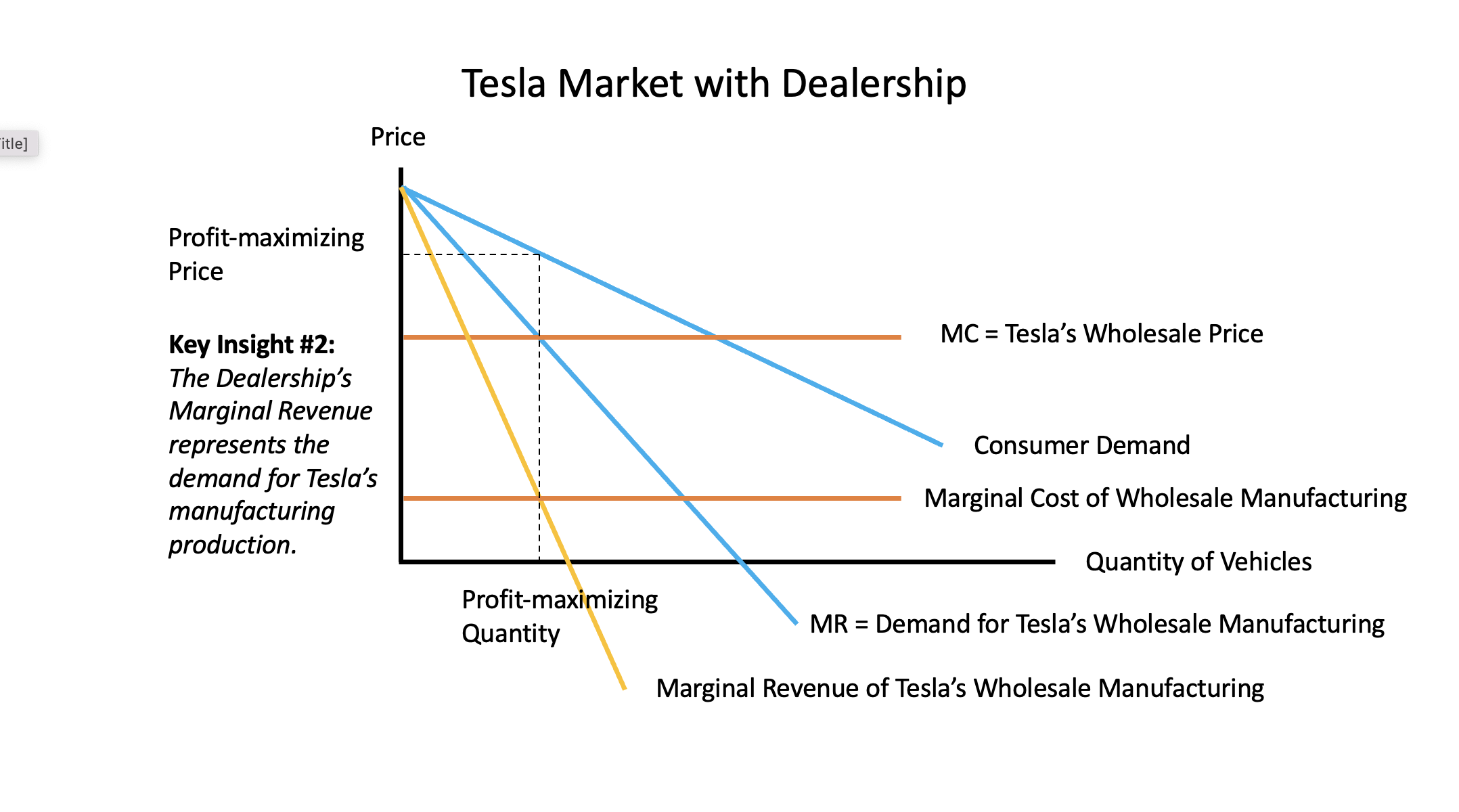

Suppose Tesla used the traditional dealership model.

- What does this supply chain look like?

- How are prices and costs related among members of the supply chain?

- How can we anticipate firms to profit maximize under these conditions?

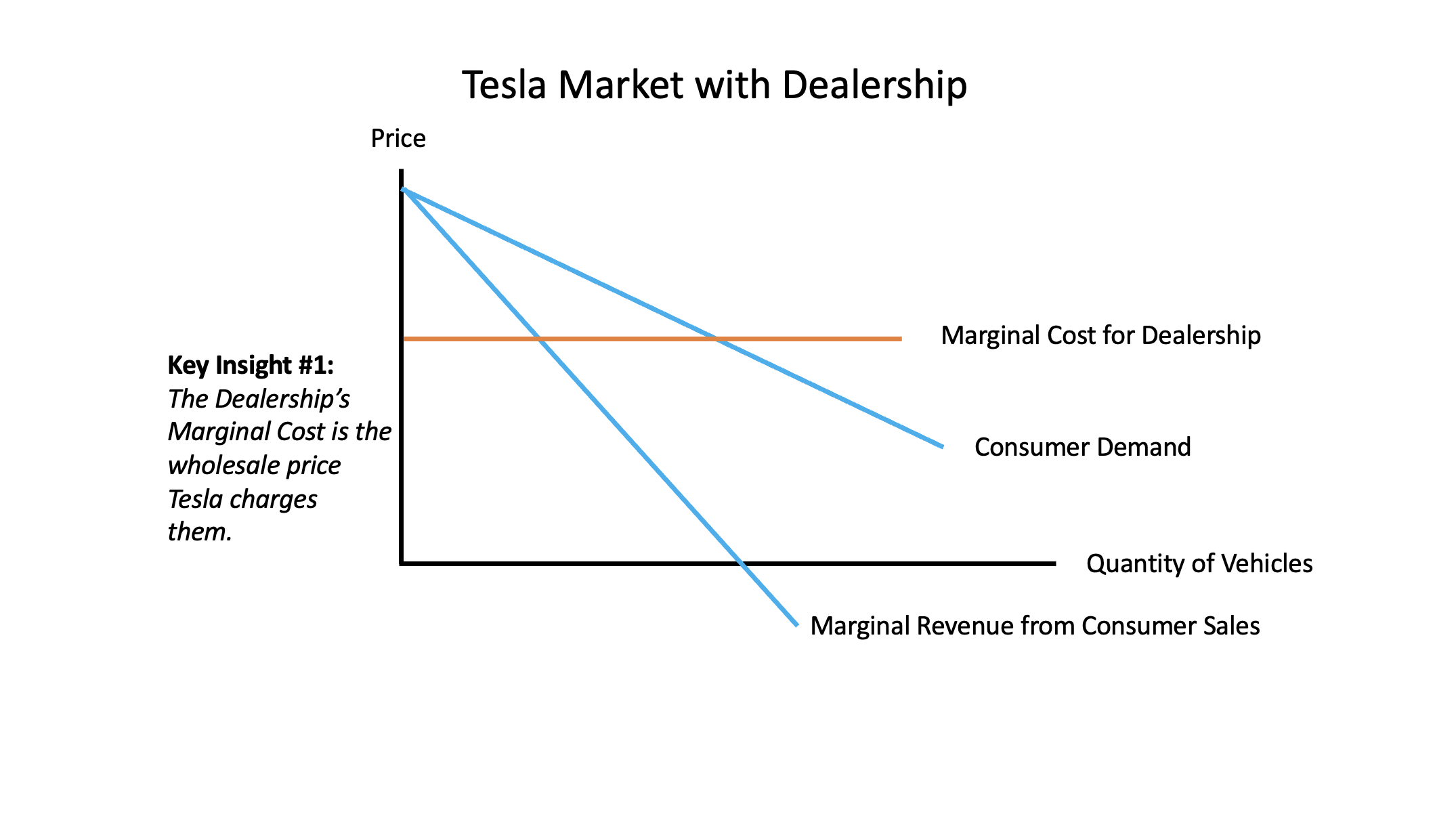

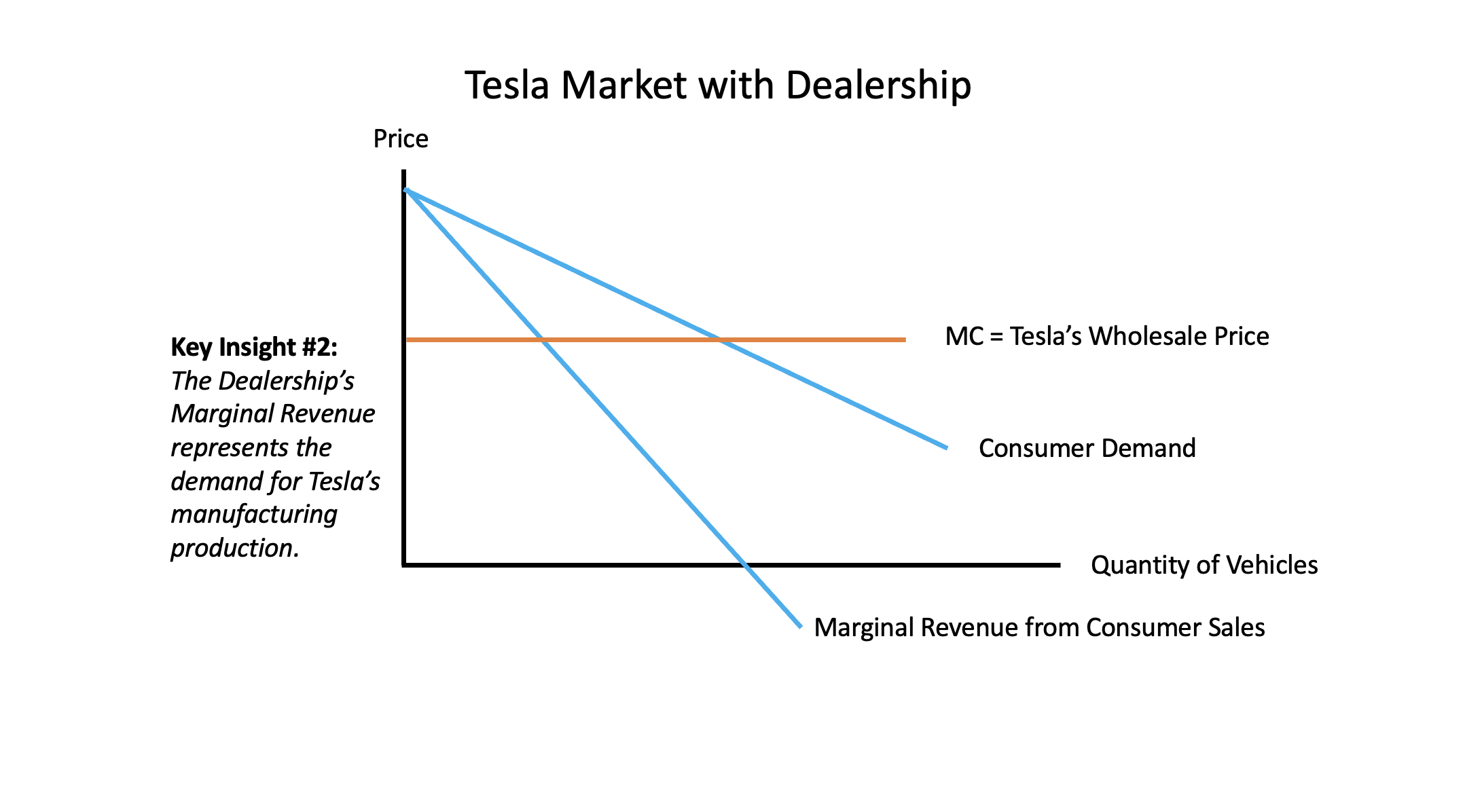

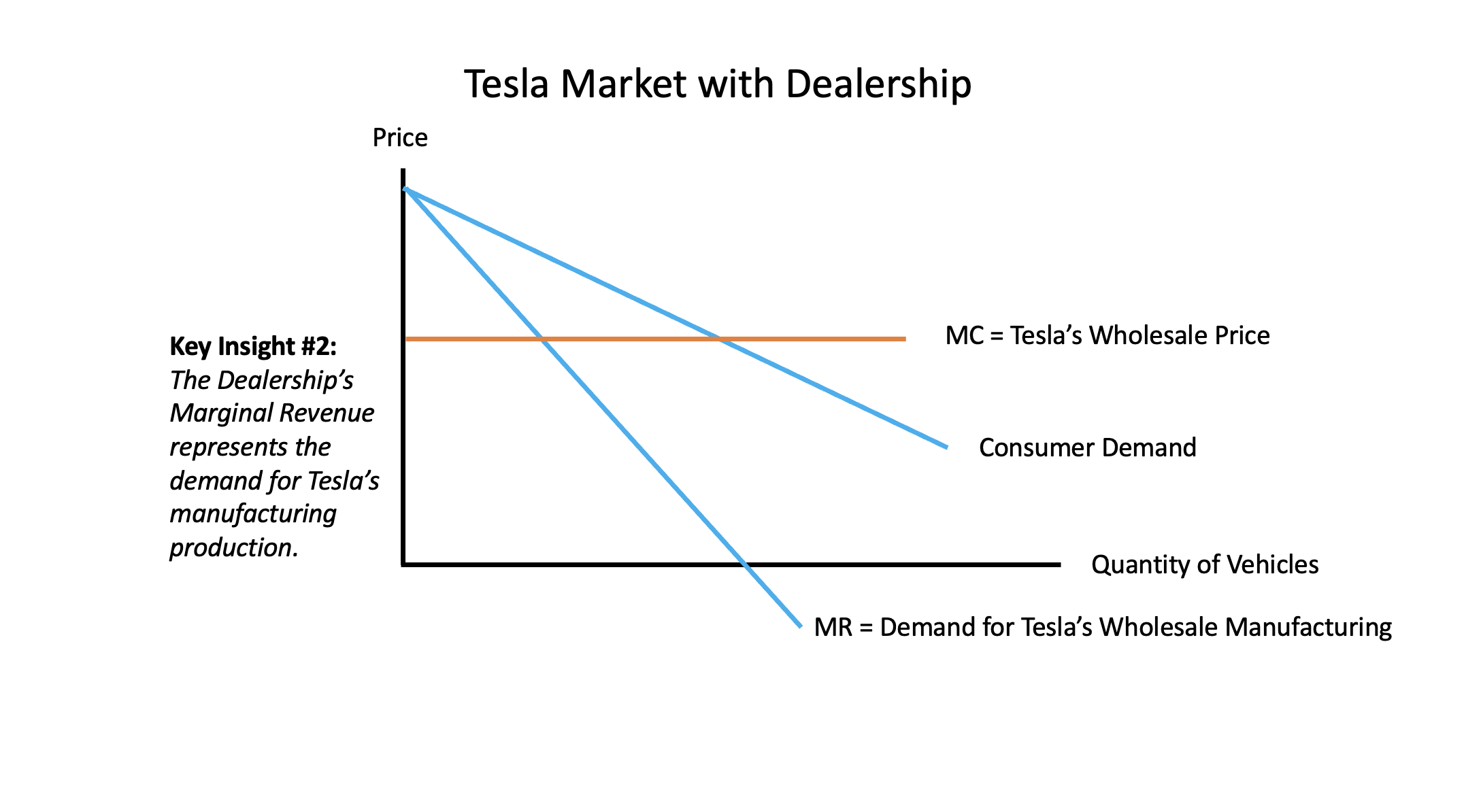

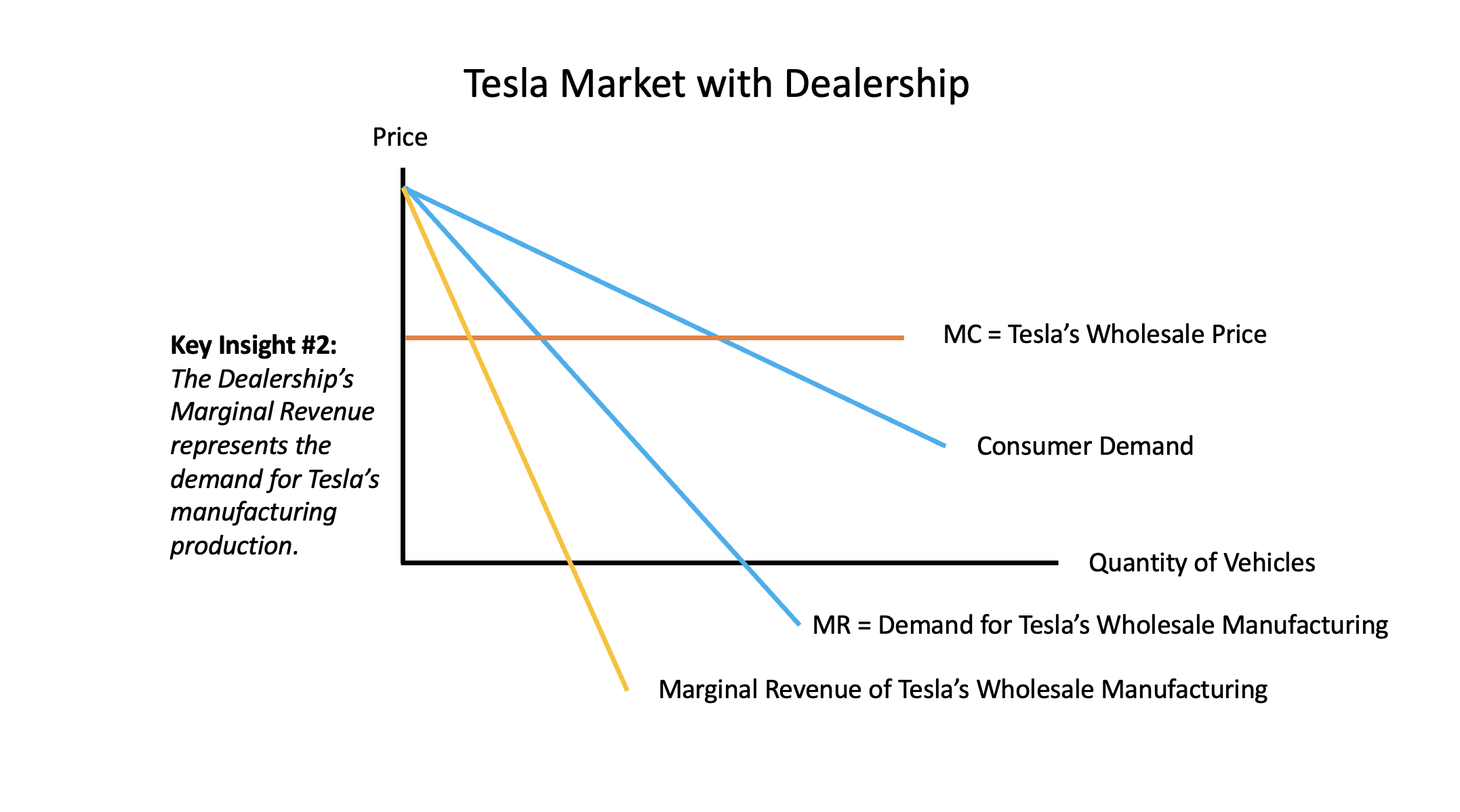

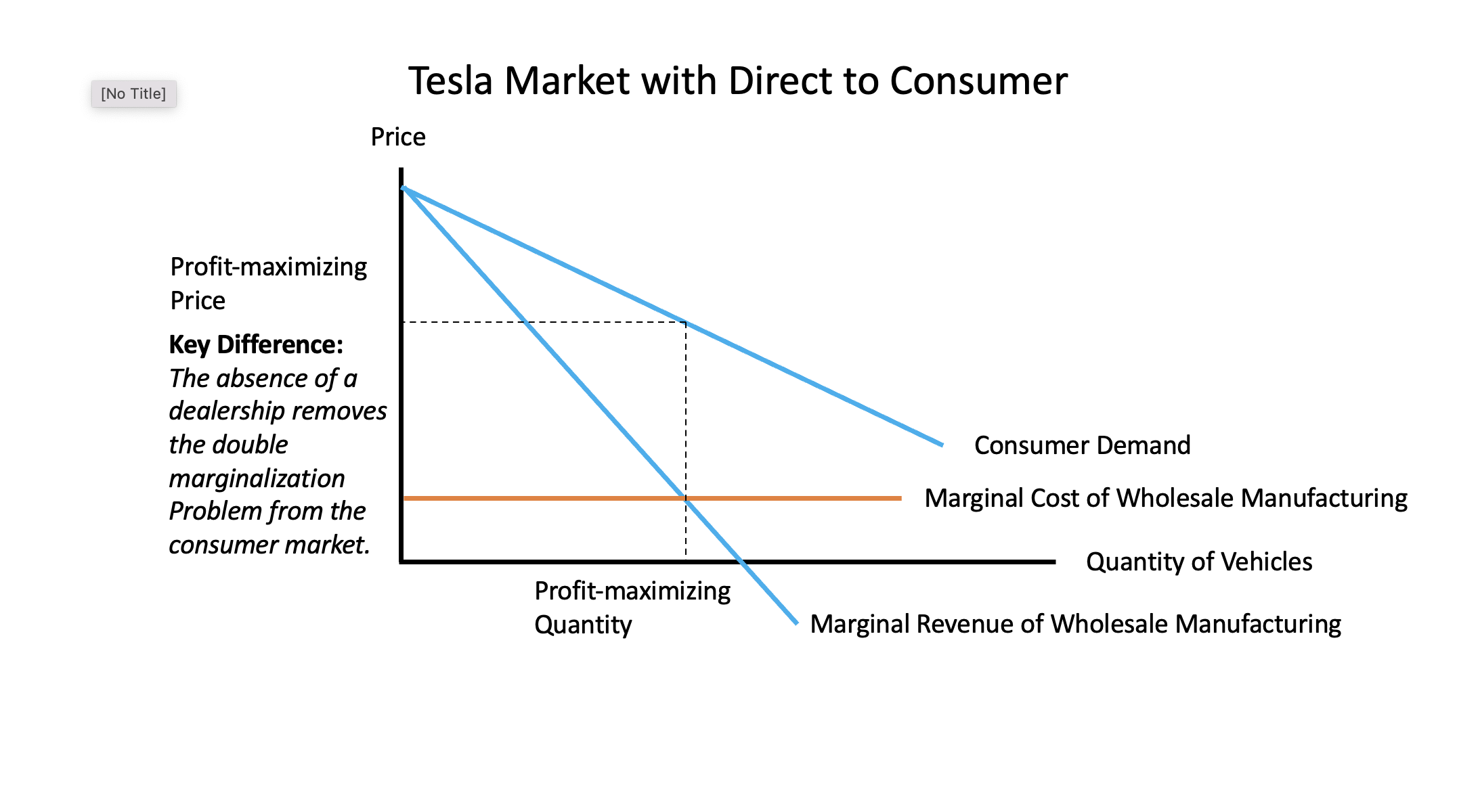

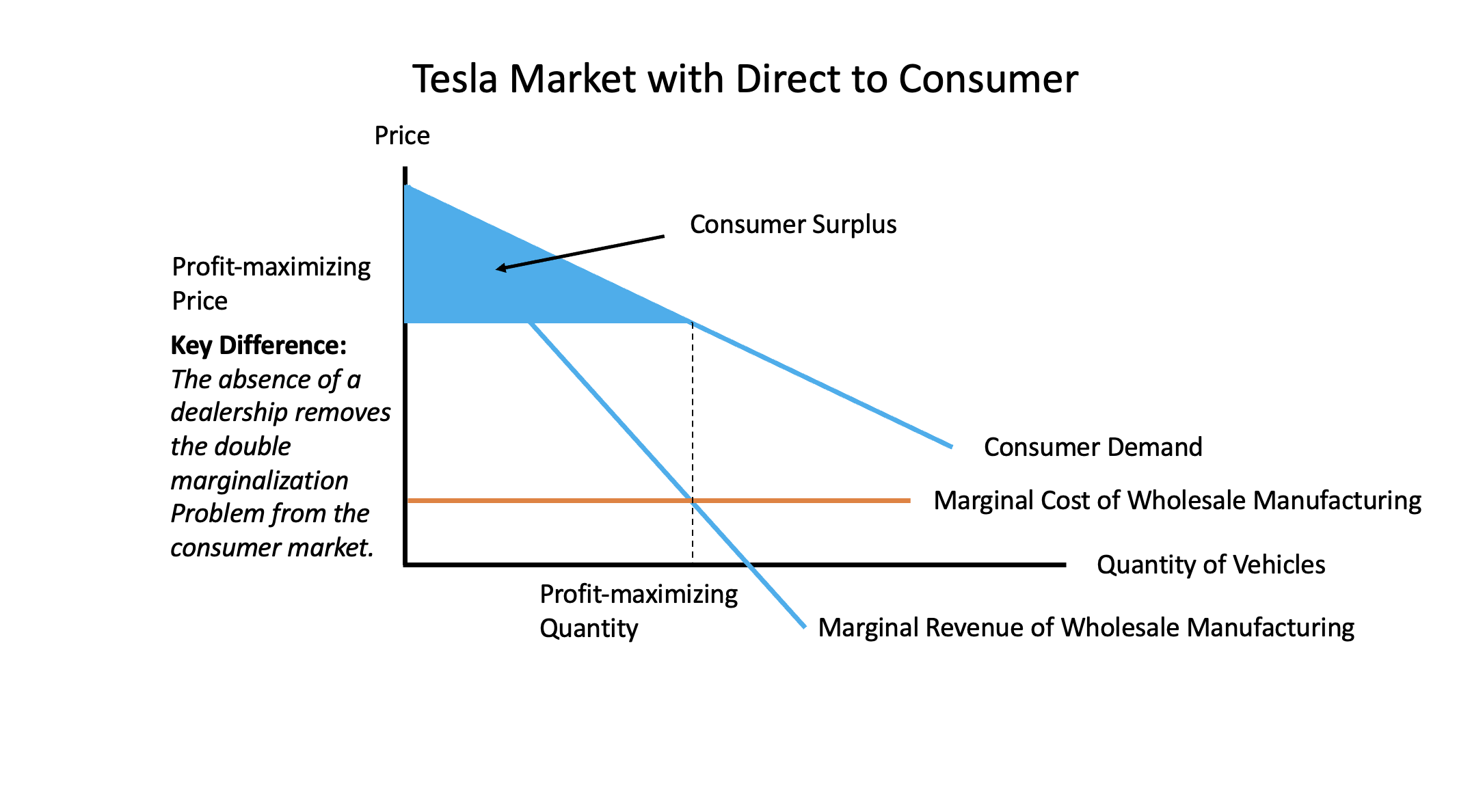

Double marginalization.

A result for supply chains in which each member has market power, and therefore adds their own markup to the next downstream firm/consumer.

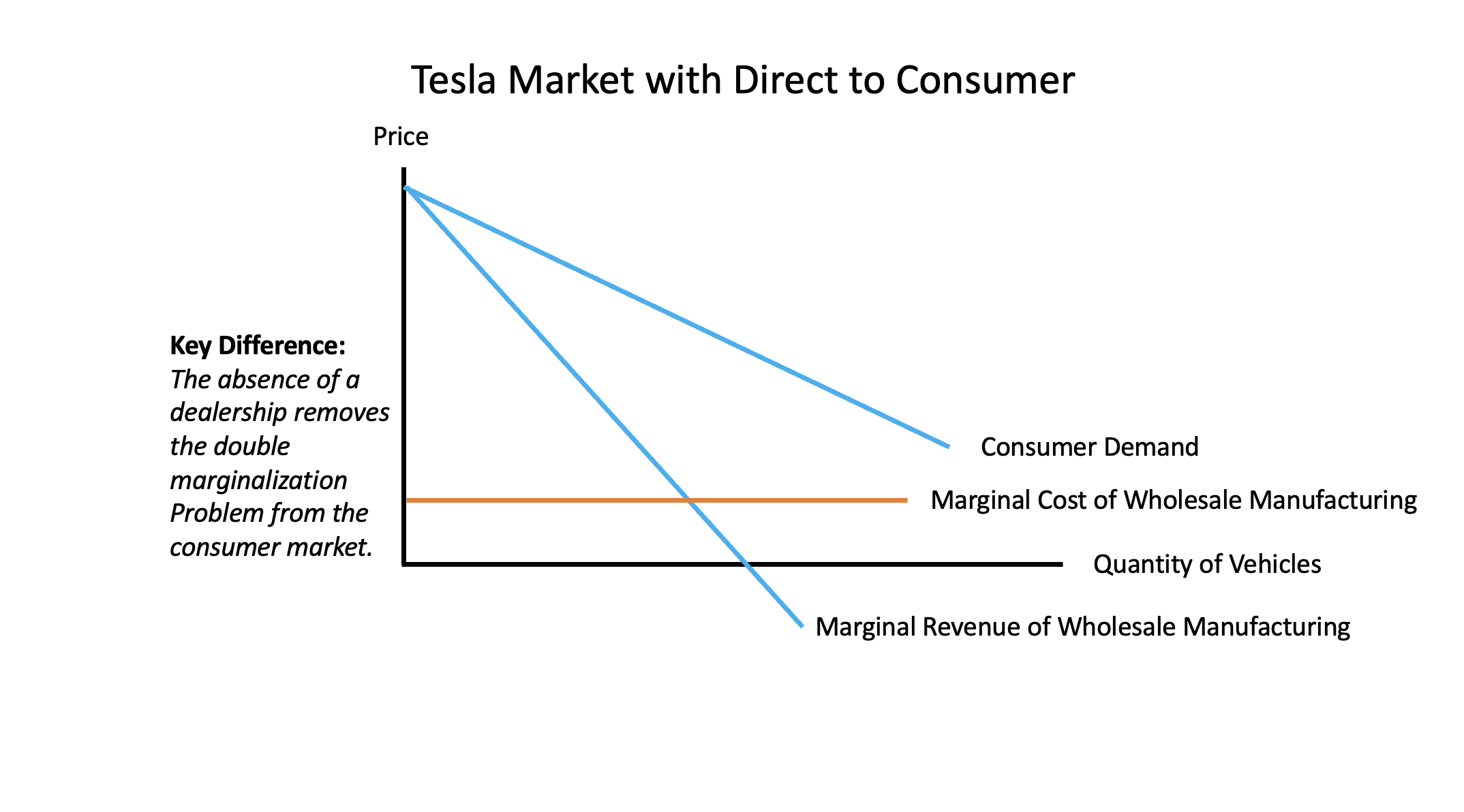

Now suppose Tesla runs their own showrooms.

- How does the supply chain change?

- What happens to the double marginalization problem?

- Is this likely to improve Tesla's profits?

Now let's reverse direction.

- Is there anything we can say regarding battery production, other upstream components?

- How might owning upstream assets/production technologies help Tesla?

- Why might this help other products in their brand eco-system?

- How might vertical integration pose risks for Tesla?

- What kinds of headaches did the relatively high in-sourcing cause for Tesla?

Key takeaways.

- Tesla trades off on asset specificity. That is, it relinquishes control over some elements of production in order to procure specific benefits, such as speed to market and the spreading of investment costs through time.

- Tesla strategically keeps many parts of its business in-house, such as direct to consumer sales, in order to fully capture the value of their product among consumers as their own revenue. Otherwise, Tesla would have to contend with the double marginalization problem.

- While much of the current US legislation on motor vehicle sales is designed to protect the dealership model, there is reason to believe that consumers would benefit from removing this middle-man from the supply chain and allowing manufacturers to operate their own showrooms.